- Fully Regulated

- Expertly Reviewed

- Secure & Trusted

- Transparent Fees

- Mobile Friendly

Find The Best Broker For Your Trading Level.

NASDAQ forex Brokers

Cryptocurrency Trading platforms

Volitality 75 Forex Brokers

How to Buy Bitcoin

Forex Trading in Cameroon

We explore everything from A -Z how to become a skillful trader and what is forex trading for beginners in Cameroon.

For Cameroonian Investors, forex trading can be a way to diversify.

Quick Content

Pros and Cons of Forex Trading

What is Forex Trading in Cameroon?

Currency Pairs

How to Start Trading Forex in Cameroon

Forex Terminology

Forex Charting

Forex Trading Risk Management

Forex Trading Strategies

Forex Trading Platforms

Best Forex Brokers in Cameroon

Welcome to our comprehensive introduction to Forex trading in Cameroon, designed to bring you key insights into the dynamic world of foreign exchange markets in this vibrant African nation.

From understanding the regulations that govern the sector to identifying the top forex brokers in Cameroon, this article serves as a stepping stone for individuals looking to venture into forex trading.

This comprehensive guide will teach you all you need to know about being a great trader and which forex brokers in Cameroon best suit your trading style. Cameroon traders can easily start earning profits from the competitive, exciting environment of forex trading.

➡️ The Forex market in Cameroon is regulated by the Bank of Central African States (BEAC), which also approves Forex brokers operating in the country. Some of the top Forex Brokers in Cameroon as of 2023 are Exness, AvaTrade, and Trade Nation.

➡️ Forex trading is legal in Cameroon, and the country boasts a potential trader population of roughly 25.88 million people. The Interprofessional Committee of the Insurance Market (Conférence Internationale des Marchés d’Assurances-CIMA) and the Central African Banking Commission (COBAC) regulate the local financial markets. There are no local regulatory bodies specific to Forex trading. Thus traders usually choose internationally regulated Forex Brokerage firms with which to invest.

➡️ The popularity of Forex trading has been on the rise globally, with the market size reaching $1.93 quadrillion in 2023. Interestingly, mobile trading surpassed desktop trading for the first time in 2022, with 55% of traders preferring using a mobile device and trading app. Given the global nature of forex trading, this trend is also likely to be mirrored in Cameroon.

➡️ Some of the world’s leading brokers, such as Tickmill, provide the education and resources for Forex trading in Cameroon. These platforms offer advanced order routing capabilities, low-latency connectivity, and customizable pricing to facilitate superior trade transactions and cater to all client types and trading strategies. They also offer continuous support and ensure the trading experience of their clients is not interrupted.

➡️ Given the lack of local regulatory bodies for Forex trading, many Cameroonian traders have turned to Islamic Forex trading, which is legal and readily available in the country. This trading style allows local Muslim investors, who comprise roughly 25-30% of the according to Sharia Law.

How profitable is forex trading for individuals and retail traders? How much do you need to start trading forex in Cameroon? Can you keep your full-time job while you trade forex part-time? What are the significant risks involved with trading forex in Cameroon?

These are just a few questions that many Cameroon traders may have as beginner forex traders. Explore our website to find the answers to these questions and more.

Foreign Exchange Trading is a legal activity in Cameroon governed by the Bank of Central African States (BEAC). Furthermore, CoSUMAF, the Commission de Surveillance du Secteur Financier de l’Afrique Centrale, supervises investment businesses, deposit-taking institutions, and other financial institutions in Cameroon.

The mandate of COSUMAF does not, however, expressly include forex brokers who operate outside of the traditional banking system.

While the Bank of Cameroon does not officially regulate forex brokers who carry out financial activities, regulators such as the FSCA, FCA, CySEC, and others protect Cameroon traders.

We reveal the best brokers with verified regulations who offer their services locally in Cameroon. Cameroon traders can rest assured that these are trusted and legitimate brokers that garner a high trust score or rating.

10 Best Forex Brokers in Cameroon

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is Forex Trading in Cameroon?

Cameroon’s Forex trading scene stands out due to the country’s specific economic and regulatory landscape. Unlike conventional markets, Forex trading allows Cameroonian traders to engage with international currency markets via digital platforms seamlessly.

The appeal of this market is derived from its high liquidity and the possibility of profiting from fluctuations in currency value.

Foreign exchange trading is practised by Cameroonians not solely for investment purposes but also as a hedging mechanism against currency risk, particularly considering the volatile characteristics of the euro-pegged Central African CFA franc.

Domestic and global economic indicators impact foreign exchange conditions in Cameroon. The nation’s Commodity exports, predominantly crude oil and agricultural products, substantially influence currency patterns.

Furthermore, the foreign exchange market is significantly influenced by global economic developments and trends in prominent economies. Therefore, traders from Cameroon must remain updated on international financial news.

Additionally, foreign exchange trading in Cameroon requires knowledge of the repercussions of regional economic agreements and policies.

As a member of the Central African Economic and Monetary Community (CEMAC), Cameroon is subject to various financial frameworks and regulations that may impact foreign exchange trading strategies.

Furthermore, technological progress in Cameroon has facilitated the expansion of online forex trading platforms, thereby increasing the accessibility of the market for individual traders. Nevertheless, due to this accessibility, one must exercise prudence.

Traders from Cameroon should exercise caution due to the inherent dangers, which include market volatility and the possibility of losing money.

Acquiring appropriate forex education, employing risk management tools, and remaining informed about local and global economic trends are essential for individuals to navigate the forex market effectively.

Forex Trading in Cameroon – The Current Landscape

Cameroon’s foreign exchange (forex) trading scene is encountering an exceptional transformation phase.

The upsurge in retail participation within the global currency market can be attributed to factors such as greater adoption of mobile technology and internet usage and an escalating interest in diverse investment opportunities.

This development presents promising possibilities and significant challenges for traders operating under Cameroon’s regulatory framework.

One of the most notable developments is the proliferation of online forex platforms, which provide intuitive interfaces and access to a vast array of currency pairs.

The advent of these platforms has substantially reduced the obstacles for aspiring traders, specifically young Cameroonians who are proficient in technology and enthusiastic about investigating financial prospects outside of conventional channels.

The expansion of accessibility to the foreign exchange market has undeniably stimulated engagement.

However, it also underscores the importance of prioritizing financial literacy and education to furnish traders with the requisite expertise and understanding to navigate currency speculation’s intricate and potentially hazardous realm.

Nonetheless, regulatory ambiguity remains an issue in the Cameroonian foreign exchange market. Although there are no explicit prohibitions on forex trading, the absence of a specialized regulatory framework obscures significant details, including broker supervision and consumer safeguards.

Unregulated brokers may exploit this ambiguity to subject traders to unethical practices and financial manipulation.

To bridge this existing void, it is strongly recommended that the Cameroonian government contemplate the establishment of a comprehensive regulatory framework for foreign exchange that effectively manages the tension between market accessibility and strong safeguards for consumers.

Notwithstanding the obstacles encountered, it is indisputable that prudent and well-informed foreign exchange trading can foster personal financial autonomy and stimulate economic expansion in Cameroon.

By capitalizing on fluctuations in global currencies, investment portfolios can be diversified, and alternative income streams can be generated. Moreover, heightened foreign exchange activity can potentially entice foreign investment and foster a more vibrant financial sector.

A comprehensive strategy is required to maximize the potential of foreign exchange trading in Cameroon.

It is imperative to maintain investments in financial literacy initiatives and digital infrastructure to furnish Cameroonians with the necessary resources and understanding to engage in responsible commerce.

Additionally, establishing a transparent and efficient regulatory structure will promote a trading environment that is more secure and reliable.

Regulatory Framework for Forex Trading in Cameroon

Although the foreign exchange market’s potential profits and currency fluctuations attract Cameroonian traders, the absence of a strong regulatory structure introduces an element of unpredictability to their activities.

Entering this domain necessitates a comprehensive comprehension of the current regulatory framework, its constraints, and the ramifications of traversing this financial frontier.

Current State of Play

Cameroon does not have a specialized regulatory framework for forex trading at this time. This implies that forex brokers are not subject to the oversight of a designated regulatory body, consumer protection protocols, or standardized operating procedures.

Although forex trading is not explicitly prohibited, the lack of regulation creates an environment reminiscent of the Wild West, where the possibility of unethical practices and financial manipulation is significant.

Current Regulatory Structure

More extensive financial regulations govern certain facets of foreign exchange trading. CoSUMAF, the Commission de Surveillance du Secteur Financier de l’Afrique Centrale, is entrusted with supervising investment firms, deposit-taking institutions, and other financial institutions in Cameroon.

The mandate of COSUMAF does not expressly encompass forex brokers that function beyond the confines of the conventional banking system.

Difficulties and Concerns

A lack of specialized regulation renders traders susceptible to the following vulnerabilities:

➡️ Unregulated brokers who operate with questionable business practices or licenses may prey on unsuspecting Cameroonians, resulting in possible legal complications and financial losses.

➡️ Without explicit protocols, forex brokers may partake in deceptive advertising and unjust marketing strategies, including fabricating return guarantees and concealing inherent risks.

➡️ Displeased traders encountering fraudulent activities, manipulation, or technical malfunctions on unregulated platforms have limited access to recourse mechanisms.

➡️ Systemic hazards can arise from unregulated forex market activities, which can potentially affect the financial system’s overall stability, including financial institutions.

Proximal Advancements

In light of the increasing significance and intrinsic dangers associated with foreign exchange trading, the Cameroonian government is initiating measures to establish a regulatory structure. Recent consultations and discussions indicate the following as a possible regulatory roadmap for this sector:

➡️ Capital adequacy requirements should be imposed on forex brokers to guarantee financial stability.

➡️ Developing licensing requirements that are specific to forex brokers conducting business in Cameroon.

➡️ Promoting cooperation with regional and international regulatory bodies to establish standardized and efficient regulatory frameworks.

➡️ Consumer protection measures are to be implemented, including mechanisms for mandatory disclosure of risks and dispute resolution.

Steps Ahead

Although establishing a comprehensive regulatory framework for foreign exchange trading in Cameroon is still in the works, these advancements are promising.

Establishing a resilient framework will demand the collaboration of policymakers, industry participants, and proponents of consumer protection.

Establishing a clearly defined regulatory framework that promotes transparency, safeguards consumer interests, and encourages responsible behaviour in the market can enable Cameroonian citizens to access the potential advantages of forex trading while minimizing the associated risks.

Major Currencies Traded in Cameroon

Dominant Currencies

In Cameroon, the Central African CFA Franc (XAF) holds the position of official tender. However, the foreign exchange market exhibits a vibrant tango of various international currencies.

Comprehending these significant participants in the financial market is essential for traversing routine transactions and investigating potential opportunities in forex trading.

➡️ The Euro (EUR): The euro, which originated in France and is the official currency of Cameroon’s principal trading partner, is an unchallenged force. A constant current of euros is fueled by import-export activities, which makes EUR/XAF among the most actively traded currency pairs. The activities of major French corporations in Cameroon reinforce the euro’s status as an indispensable currency.

➡️ Due to its international influence, the United States Dollar (USD) holds a significant position in Cameroon’s foreign exchange market. Utilization in global transactions, specifically hydrocarbon exports, guarantees a consistent demand for the USD. Moreover, the dollar’s appeal as a “haven” currency attracts investors and traders amidst economic uncertainty.

➡️ British Pound (GBP): The historical connections that Cameroon had with the British Empire continue to resonate within the trading halls in the form of the British Pound (GBP). While not as widely used as the euro or the dollar, the GBP is significant in specific sectors, especially agricultural exports and commerce with anglophone neighbouring countries.

➡️ The Nigerian Naira (NGN) is a significant currency in Cameroon due to the continuous movement of products and people facilitated by the country’s active land border with Nigeria. Naira demand is fueled by informal remittances and cross-border commerce, which generates a distinctive environment in the local foreign exchange market.

Emerging Currencies

In addition to these well-established individuals, a limited number of up-and-coming personalities are garnering attention:

➡️ Chinese Yuan: The increasing economic sway of China in Cameroon is manifested in a surge in trade volumes, which generates a heightened need for the Chinese Yuan (CNY).

➡️ Central African Franc: Cameroon’s membership in the Central African Economic and Monetary Community (CEMAC) resolves certain cross-border transactions in BEAC francs.

Challenges and Risks of Trading Forex in Cameroon

Although the prospect of potentially profitable profits entices Cameroonian traders to participate in the ever-evolving realm of foreign exchange trading, entering this intricate sphere is not devoid of its share of difficulties and dangers.

Successfully traversing this financial frontier necessitates a heightened cognizance of the possible drawbacks that await, in addition to a steadfast dedication to prudent risk management methodologies.

Financial Illiteracy

A deficiency in financial literacy is a prominent obstacle for traders in Cameroon. Novice traders may find the complexities of the foreign exchange market, such as margin calls, technical analysis, and leverage, to be overpowering. Insufficient comprehension may result in rash judgements, impetuous transactions, and significant monetary setbacks.

Unregulated Market

As previously mentioned, the lack of a specialized regulatory framework governing foreign exchange trading in Cameroon constitutes a significant risk factor.

Brokers who lack proper licenses and integrity and engage in questionable business practices may function without consequence, potentially committing fraudulent acts or manipulating trading platforms for their benefit.

Unaware traders are placed in a precarious position due to the absence of transparent recourse mechanisms to pursue remedies for financial misconduct.

Leverage Trap

Leverage, a dual-edged instrument that grants traders the ability to manage larger positions with restricted capital, can be especially risky when operated by novices. Leverage can exacerbate potential profits and losses if market movements deviate from initial expectations. This may result in account depletion and margin demands, placing traders in a precarious financial position.

Reliance on Technology

The preponderance of mobile devices in forex trading in Cameroon grants traders exposure to possible technological vulnerabilities. Technical errors on trading platforms, unreliable internet connectivity, and cybersecurity threats on smartphone platforms can all disrupt access, cause order delays, and result in missed opportunities or incorrect executions.

Volatility and Market Manipulation

The absence of regulatory supervision in Cameroon and the intrinsic volatility of the foreign exchange market can constitute a substantial risk factor.

Unforeseen and abrupt currency fluctuations have the potential to nullify profits and worsen losses, especially for traders who have limited time to see the future and insufficient risk management techniques.

Moreover, the lack of transparent and resilient market protocols allows specific participants to manipulate, exacerbating instability and unpredictability.

Psychological pressures

Even for experienced traders, the volatile nature of the foreign exchange market can be mentally taxing. Excessive confidence, greed, and the fear of missing out (FOMO) can impair judgment and result in rash trading decisions that deviate from sensible strategies.

It is imperative to adhere to a clearly defined risk management strategy and maintain emotional discipline to prevent psychological pressures from controlling trading behaviour.

What is the Impact of Local and Global Economic Events on Forex Trading in Cameroon?

The Cameroonian foreign exchange market is affected by changes in both domestic and international economic factors.

Various economic developments, including shifts in domestic policies and trade conflicts among nations, greatly influence fluctuations in currency exchange rates. These occurrences have extensive implications on import prices as well as investment decisions.

Local Challenges

➡️ Political and social unrest, including civil conflicts and domestic political instability, can undermine investor confidence and instigate capital flight, ultimately resulting in the devaluation of the XAF. On the contrary, a phase characterized by stable governance and favourable economic indicators has the potential to entice foreign investment and bolster the currency.

➡️ The decisions concerning money supply and interest rates made by the Bank of Central African States (BEAC) directly impact the value of XAF. An increase in monetary policy may lead to a fall in the franc, affecting import prices negatively while reducing foreign investment inflows.

➡️ The economy of Cameroon is significantly dependent on the exportation of resources, specifically cocoa and oil. Variations in worldwide commodity prices have an immediate impact on the value of the XAF. For instance, increasing crude prices can invigorate the franc, whereas a decrease can exert a depreciating force on the currency.

Global Impacts

➡️ Broader global economic cycles, including expansions and contractions, can exert a substantial influence on the economy and currency of Cameroon. Demand for Cameroonian exports may decrease if significant trading partners, such as the Eurozone, experience a slowdown, which would depreciate the XAF. A global economic expansion, on the other hand, can stimulate investment and trade, thereby bolstering the currency.

➡️ The overall sentiment towards emerging markets can also have an impact on the value of the XAF. A surge in risk aversion among investors may result in capital outflow from developing economies such as Cameroon, thereby depreciating the franc. On the contrary, an upsurge in investor confidence regarding emergent markets has the potential to draw in foreign investment and bolster the currency.

➡️ The policies of major central banks, notably the Federal Reserve in America and the European Central Bank, regarding quantitative easing initiatives or interest rates can heavily impact XAF’s value. These decisions may have global implications on currency markets.

Making Sense of the Currents

A comprehensive comprehension of the intricate dynamics between domestic and international economic occurrences is imperative for enterprises, investors, and foreign exchange traders in Cameroon. Individuals can make well-informed decisions regarding imports, exports, investments, and forex trading strategies by remaining alert to significant domestic and international economic indicators and predicting possible market responses.

Future Outlook of Forex Trading in Cameroon

Regulatory Landscape

The emerging regulatory framework governing foreign exchange trading in Cameroon is anticipated to progress, potentially enhancing consumer protections and enticing more reputable brokers. Enhanced confidence and participation could result from a more secure and transparent market environment that this could promote. In determining the market’s future course, the rate and efficacy of regulatory development will be pivotal factors.

The progression of technology

The increasing prevalence of mobile-centric forex trading in Cameroon is positioned for a further surge. Further developments in mobile technology, such as enhanced security functionalities and intuitive interfaces, are expected to draw more traders to the industry. In addition, the rise of artificial intelligence and algorithmic trading may present Cameroonian traders with new opportunities and risks.

The Human Factor

In Cameroon, the decisions and behaviours of its traders will ultimately determine the course of forex trading.

Individual traders must prioritize education and risk management, adopt responsible trading practices, and be able to adapt to the ever-changing regulatory and technological environment to navigate the market successfully.

Global Economic Integration

As a result of Cameroon’s growing integration into the global economy, its foreign exchange market will likely be subject to a greater variety of international influences. Potentially, this could result in heightened fluctuations and require a more flexible implementation of trading tactics.

Furthermore, establishing regional currency cooperation within the Central African Economic and Monetary Community (CEMAC) may present fresh risk mitigation and diversification prospects.

Financial Education

The continued importance of financial literacy among traders in Cameroon cannot be overstated.

Implementing educational campaigns and initiatives to raise awareness regarding responsible trading practices, risk management strategies, and market dynamics will be critical in safeguarding traders against potential pitfalls and ensuring sustainable growth.

Forex Trading Pros and Cons

| ✔️ Pros | ❌ Cons |

| Forex trading is legal in Cameroon | There are no local regulatory bodies specifically for Forex trading in Cameroon, so traders must choose an internationally regulated Forex brokerage firm with which to invest |

| There are numerous Forex brokers available to Cameroonian traders | Trading Contracts for Difference (CFDs) on margin carries a high level of risk. The high degree of leverage can work against traders, leading to the loss of some or all of their initial trading capital |

| Islamic Forex trading is legal and available in Cameroon | Traders need to carefully select their brokers, considering factors such as response time, execution speed, spread, fill ratio, slippage, and market impact |

| Forex markets offer high liquidity, with a daily turnover of $7.5 trillion as of 2022 | Forex trading involves the exchange of over 170 different currencies, making it a complex endeavour that requires deep understanding and skills |

| The Forex market operates 24 hours a day, allowing traders to participate at any time that suits them | Emerging market currencies, which Cameroonian traders might be more inclined to trade, constitute a smaller percentage (18%) of all Forex trades, potentially introducing additional volatility and risk |

Step-by-Step on How to Start Trading Forex in Cameroon

Before engaging in forex trading, it is important to have a firm grasp of the fundamentals. Inform yourself about the forex market, its participants, and the trading of currency pairs.

Explore online resources, read books, enrol in online courses, or attend seminars to understand forex trading’s fundamental concepts.

Acquaint yourself with the terminology commonly used in forex trading. The terms pips, lots, leverage, margin, stop-loss orders, and take-profit orders are among the most important. These terms will aid you in navigating the foreign exchange market and communicating with other traders.

Register for a demo account with a reputable forex broker to gain practical experience without risking real cash.

This allows you to trade with virtual funds in a simulated environment. Practice your trading strategies, experiment with different approaches, and familiarise yourself with the trading platform provided by your broker.

Forex trading entails inherent risks, which must be taken into account. Examine risk management techniques, such as establishing appropriate stop-loss levels and effectively managing leverage.

Realize that forex trading involves the risk of capital loss and only trade with money you can afford to lose.

Examine the diverse trading strategies utilized by forex traders. There are numerous approaches, such as fundamental analysis, sentiment analysis, and technical analysis.

Examine chart patterns, indicators, and economic factors affecting currency fluctuations. Create a trading strategy that matches your risk appetite and trading style.

Utilize your demo account to implement the acquired trading strategies. Practice chart analysis, placing trades, and position management.

Evaluate the effectiveness of various strategies and make necessary adjustments. Before switching to a real account, use this phase to gain confidence in your trading abilities.

Open a real trading account with a reputable forex broker when you have gained sufficient experience and confidence through your demo account.

Per the broker’s instructions, complete the registration procedure by providing the required personal information and documentation. Ensure that you adhere to Cameroon’s regulatory requirements.

Choose an appropriate trading platform provided by your broker. When selecting a trading platform, consider usability, available features, technical analysis tools, and compatibility with your trading devices (desktop, mobile, web).

Furthermore, acquaint yourself with the platform’s functionalities and practice efficiently navigating it.

After establishing a real account, deposit funds into it using a broker-accepted payment method. Determine how much you are willing to invest and transfer the funds accordingly. As soon as the funds have been deposited into your trading account, you can begin trading on the live forex market.

4 Best Currency Pairs for Beginner Cameroon Traders to Trade

Suppose you are a beginner in Cameroon looking to venture into the exciting world of forex trading. In that case, choosing currency pairs that offer good liquidity and stability while being suitable for beginners is essential.

Here are four currency pairs that are commonly recommended for beginner traders: EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), USD/JPY (US Dollar/Japanese Yen), and AUD/USD (Australian Dollar/US Dollar).

These pairs are widely traded, have ample market activity, and provide relatively predictable price movements. Focusing on these currency pairs allows you to gain valuable trading experience while navigating the forex market more easily.

Remember, thorough analysis and risk management strategies are crucial when trading any currency pair, regardless of your experience level.

EUR/USD (Euro/US Dollar)

EUR/USD (Euro/US Dollar) is the world’s most actively traded currency pair, and its spread is typically the tightest.

The pair is highly liquid, which contributes to its stability and predictability. This could be a good starting point for a novice trader in Cameroon due to its stability and abundance of analysis and information.

USD/JPY (US Dollar/Japanese Yen)

This pair is highly liquid and has generally low spreads. The economies of the United States and Japan are robust and stable, making this pair less volatile than others.

GBP/USD (British Pound/US Dollar)

The United States dollar and the British pound are two of the most influential currencies in the world. This pair can be somewhat more volatile than the EUR/USD and USD/JPY, but it is still suitable for beginners due to its high liquidity and market analysis accessibility.

AUD/USD (Australian Dollar/US Dollar)

Commodity prices, particularly gold, frequently influence this currency pair. This pair could be an excellent option for beginners interested in commodity markets. Additionally, it is less volatile than other currency pairs.

4 Best Currency Pairs for Professional Cameroon Traders to Trade

For professional traders in Cameroon seeking opportunities in the forex market, it is crucial to consider currency pairs that offer liquidity, volatility, and potential for profit. Here are four currency pairs that professional traders commonly favour.

EUR/JPY (Euro/Japanese Yen)

This is a major cross-currency pair, which tends to be more volatile than USD-based major pairs. This could provide more opportunities for professional traders seeking to capitalize on larger price fluctuations.

GBP/JPY (British Pound/Japanese Yen)

This pair, known as the “Beast,” is extremely volatile, potentially lucrative and risky. It necessitates thorough market knowledge and prudent risk management, making it more suited for professional traders.

USD/CAD (US Dollar/Canadian Dollar)

Canada is one of the largest oil producers in the world, so oil prices significantly impact this pair. Those who thoroughly understand the oil market may find lucrative trading opportunities with this pair.

AUD/NZD (Australian Dollar/New Zealand Dollar)

This currency pair consists of two currencies from countries with comparable economic structures and close geographic proximity. It can be less predictable and more volatile, providing opportunities for professional traders with a firm grasp of these economies.

11 Best No-Deposit Forex Brokers in Cameroon

| ⚖️ No-Deposit Broker | 🎉 Open an Account | 🤝 Bonus Amount | 🏦 Regulation | 📊 Trading Accounts Offered | 💻 Trading Platforms |

| 1. AVFX | Open Account | 100 USD / 59,915 UTC | None | Raw Spread ECN PRO Mini Classic ECN Swap-Free | MetaTrader 4, MetaTrader 5 |

| 2. XM | Open Account | 30 USD / 17,974 UTC | FSCA, IFSC, ASIC, CySEC, DFSA | Micro Standard XM Ultra-Low Shares | MetaTrader 4, MetaTrader 5, XM Mobile App |

| 3. ForexChief | Open Account | 100 USD / 59,915 UTC | VFSA | MT4.DirectFX MT4.Classic+ Pamm-MT4.DirectFX Pamm.MT4.Classic+ Cent-MT4.DirectFX Cent-MT4.Classic MT5.DirectFX MT5.Classic+ Pamm-MT5.DirectFX Pamm.MT5.Classic+ Cent-MT5.DirectFX Cent-MT5.Classic | MetaTrader 4, MetaTrader 5 |

| 4. Kaje Forex | Open Account | 50 USD / 29,957 UTC | None | Spread Active Traders EA Robot ECN | MetaTrader 4 |

| 5. InstaForex | Open Account | 1,000 USD / 599,156 UTC | BVI FSC, CySEC, FSA SVG, FCA | Insta.Standard Insta.Eurica Cent.Standard Cent.Eurica | MetaTrader 4, MetaTrader 5, WebIFX, InstaForex Multi-Terminal, InstaForex WebTrader, InstaTick Trader, InstaForex MobileTrader |

| 6. Skilling | Open Account | 30 USD / 17,974 UTC | FSA, CySEC | Standard Premium | Skilling Trader, Skilling cTrader, Skilling MetaTrader 4, Skilling Copy |

| 7. Tickmill | Open Account | 30 USD / 17,974 UTC | FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA | Pro Classic VIP | MetaTrader 4, MetaTrader 5, Tickmill App |

| 8. Templer FX | Open Account | 30 USD / 17,974 UTC | None | Universal FX XBTC Cent FX MAM Muslim FX Segregated Account | Templer FX Trader, MetaTrader 4 |

| 9. JustMarkets | Open Account | 30 USD / 17,974 UTC | FSA | Standard Pro Raw Spread | MetaTrader 4, MetaTrader 5, JustMarkets App |

| 10. Windsor Brokers | Open Account | 30 USD / 17,974 UTC | FSC, CySEC, JSC, FSA, CMA | MT4 Zero MT4 Prime VIP ZERO | MetaTrader 4, Windsor Brokers App |

| 11. Baxia Markets | Open Account | 30 USD / 17,974 UTC | SCB, FSA | Bx Standard Bx Zero Bx Cent | MetaTrader 4, MetaTrader 5 |

Forex Trading vs Stock Trading vs Cryptocurrency – Compared

| 🏅 Forex Trading | 🏅 Stock Trading | 🏅 Crypto Trading | |

| ⏰ Market Hours | 24/5 | 9 am – 3 pm (GMT+3) Monday to Friday | 24/7 |

| ⚖️ Trading Speed | Instant | Slow | Instant |

| 🛍 How is it traded? | OTC | Exchanges | OTC/Exchanges |

| 💳 Price Fluctuation | Fast | Slow | Fast |

| 📊 Min. Trade Size | 0.01 lots | 1 share or fractions | 1 lot or fractions |

| 📈 Volatility | High | Low | High |

| 📉 Liquidity | Very High | Blue Chip Stocks are the most liquid | Only major crypto, e.g. BTC, ETH, LTC, DOGE, etc. |

| 💹 Trading Volume | High | High | Medium |

| 🤝 Regulation | $6.6 Trillion | 7,369,200 | $500 Billion+ |

| 💱 Investment Horizon | Short, Medium, and Long-Term | Medium and Long-Term | Short, Medium, and Long-Term |

| ✅ Average Leverage Ratios | 1:100 – 1:3000+ | <1:100 | <1:10 |

| 💸 Susceptibility to Macroeconomic Factors | Yes Rarely as turbulent as Crypto | Yes Economic Performance | Yes Consumer Behaviour Supply and Demand |

5 Most Successful Forex Traders in Cameroon

While we could not pinpoint the most successful forex traders specifically in Cameroon, here are the 5 most successful Forex Traders in Africa overall:

Secrets to the Success of These Professional Traders

Sandile Shezi (South Africa)

Sandile Shezi is a self-taught forex trader from South Africa who became widely recognized for his achievements in the industry. He started trading at a young age and quickly made a name for himself by turning a small investment into a substantial fortune.

Shezi co-founded the Global Forex Institute to educate and mentor aspiring African traders, empowering them to succeed in the forex market.

George van der Riet (South Africa)

George van der Riet, another South African trader, is renowned for his success in forex trading. He co-founded the Global Forex Institute alongside Sandile Shezi and was crucial in empowering individuals with forex trading skills.

Van der Riet’s trading expertise and dedication to education and mentorship have inspired many African traders to pursue their forex trading goals.

Ref Wayne (South Africa)

Ref Wayne, also known as Refiloe Nkele, is a self-made millionaire and forex trader from South Africa. He founded Pipcoin, a cryptocurrency known for his innovative trading strategies.

Wayne started his trading journey at a young age and has achieved significant success through his unique approach to forex trading. He has been an influential figure in the African forex trading community, mentoring and educating aspiring traders.

Simz D’ Mandla (South Africa)

Simz D’ Mandla, a South African forex trader, is recognized for his remarkable trading skills and entrepreneurial achievements. He is known for navigating the forex market successfully and generating consistent profits.

D’ Mandla’s story of overcoming adversity and building a thriving trading career has inspired many traders in Africa and beyond.

Hither Mann (Zimbabwe/United Kingdom)

Hither Mann is a successful forex trader and entrepreneur from Zimbabwe, now based in the United Kingdom. She founded Fortune Academy, a platform that provides forex education and coaching to individuals worldwide.

With her expertise in forex trading and wealth creation, Mann has empowered countless individuals to achieve financial independence through trading.

How to Choose a Forex Broker in Cameroon

Choosing the right forex broker in Cameroon is a crucial decision that can significantly impact your trading experience and success. To make an informed choice, consider the following factors.

Regulation and Authorization

Ensure a reputable financial authority regulates the broker. Look for brokers regulated by well-known bodies such as the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), or the Australian Securities and Investments Commission (ASIC).

Regulation provides oversight and protection for traders, ensuring fair practices and fund security.

Trading and Non-Trading Fees

Compare the trading fees, including spreads, commissions, and overnight financing charges. Different brokers may have varying fee structures, so evaluate the costs associated with your trading strategy.

Additionally, consider non-trading fees like deposit/withdrawal fees, inactivity fees, or account maintenance charges.

Range of Markets

Check the variety of markets offered by the broker. Besides major currency pairs, assess their selection of commodities, indices, stocks, and cryptocurrencies. A broader range of markets allows you to diversify your trading portfolio and exploit different market opportunities.

Customer Support

Evaluate the level and quality of customer support provided by the broker. Look for brokers offering responsive and multilingual customer service, preferably 24/7. Test their support channels, such as live chat, email, or phone, to ensure prompt and helpful assistance when needed.

Accounts and Features

Consider the types of trading accounts offered by the broker. Assess the account features, such as leverage, minimum deposit requirements, and account currencies. Different account types cater to different trading styles and capital levels, so choose one that aligns with your needs.

Trade Execution and Overall Execution Policy

Research the broker’s trade execution policy, including their order types, execution speed, and whether they operate as a dealing desk (market maker) or provide direct market access (ECN/STP). Efficient trade execution is vital for capturing market opportunities without delays or slippage.

Client Security and Fund Safety

Ensure the broker maintains segregated client accounts, keeping your funds separate from their operational funds. Also, check if the broker offers negative balance protection to prevent you from owing more than your account balance in volatile market conditions.

Education and Research

Consider the educational resources and research tools provided by the broker. Look for educational materials, webinars, market analyses, and economic calendars. A broker that invests in educating its clients can enhance your trading knowledge and decision-making abilities.

Trading Platform

Evaluate the trading platform offered by the broker. Consider factors such as its user-friendliness, stability, availability of advanced charting tools, and compatibility with your devices.

Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their comprehensive features and broad community support.

Awards and Recognition

Check if the broker has received any industry awards or recognition for their services. Awards can indicate the broker’s commitment to excellence and client satisfaction.

Online Reviews

Read reviews and testimonials from other traders to gauge their experiences with the broker. Consider both positive and negative feedback to get a balanced perspective. Look for review consistency and be cautious of overly positive or negative claims.

Deposit and Withdrawal Options and Speed

Assess the deposit and withdrawal methods supported by the broker. Consider the convenience, fees, and processing time associated with each option. A broker that offers a variety of secure and efficient payment methods can make transactions more convenient for you.

Before You Start Trading, Read these Few Basics to Forex Trading

Understanding the Forex Market

Before diving into forex trading, it is essential to have a solid understanding of the forex market. The forex market, also known as the foreign exchange market, is where currencies are bought and sold. It is the largest and most liquid financial market globally, with trillions of dollars traded daily.

Currency Pairs and Exchange Rates

In forex trading, currencies are always traded in pairs. Each currency pair represents the exchange rate between the two currencies involved.

For example, the EUR/USD pair represents the Euro and US Dollar exchange rates. Understanding how currency pairs work and how exchange rates fluctuate is fundamental to forex trading.

Market Participants

Various participants contribute to the forex market’s liquidity and price movements. These participants include central banks, commercial banks, institutional investors, retail traders, and multinational corporations. Each group has different objectives and influences market dynamics in its way.

Fundamental Analysis and Technical Analysis

To determine the value of a currency, fundamental analysts examine economic indicators, geopolitical events, and central bank policies. It focuses on economic factors that affect currency prices in a country.

In contrast, technical analysis entails studying price charts, patterns, and indicators to identify potential trading opportunities. It assists traders in making decisions based on historical price movements and patterns, assuming that history repeats itself.

Risk Management

Risk management is an essential component of forex trading. It entails putting strategies in place to protect capital and minimize potential losses. Traders use risk management techniques such as setting stop-loss orders, proper position sizing, and portfolio diversification.

Understanding and implementing risk management principles is critical for long-term success in forex trading.

Leverage and Margin

Leverage enables traders to control larger positions in the market with less capital. Profits and losses are magnified.

While leverage can magnify potential gains, it also raises the risk of significant losses. Traders must understand leverage and margin requirements and apply them responsibly.

Demo Trading and Education

Before risking real money, it is strongly recommended to trade on a demo account. A demo account enables traders to familiarise themselves with the trading platform, test various trading strategies, and gain experience without financial risk.

Investing in education via courses, tutorials, and books can also significantly improve trading knowledge and abilities.

Choosing a Reliable Broker

Selecting a reliable and reputable forex broker is vital. Consider regulation, trading platform features, customer support, fees, and account types. Researching and comparing different brokers can help ensure a safe and efficient trading experience.

Emotional Control and Discipline

Emotional control and discipline are crucial traits for successful forex trading. Traders must remain calm and rational, avoiding impulsive decisions driven by fear or greed. Developing a trading plan, sticking to it, and managing emotions effectively are essential for consistent profitability.

20 Forex Terms You Must Know

Here are 20 essential forex terms and their definitions to help you navigate the world of forex trading:

1️⃣ Pips represent the smallest unit of currency measurement. It is the fourth decimal place in the majority of currency pairs.

2️⃣ Spread: The difference between a currency pair’s bid price (selling price) and ask price (buying price). It represents the trading cost.

3️⃣ Lot: A standard trading unit used to quantify the volume of a transaction. A standard lot consists of one hundred thousand units of the base currency.

4️⃣ Leverage is the ratio between the trader’s capital and the broker’s borrowed funds. It increases both gains and losses.

5️⃣ Margin: The required amount of capital to open and maintain a trading position. It represents a portion of the total transaction size and serves as collateral.

6️⃣ Stop-Loss Order: An order placed by a trader to close a position automatically at a predetermined price level to limit potential losses.

7️⃣ Take-Profit Order: An order a trader places to close a position automatically at a predetermined price level to secure profits.

8️⃣ Equity: The current value of a trader’s account when open positions, profits, and losses are accounted for.

9️⃣ Margin Call: A notice from the broker to deposit additional funds into the trading account when the equity falls below a certain level required to support open positions.

1️⃣0️⃣Bullish: A market sentiment indicating optimism and the anticipation of price increases.

1️⃣1️⃣ Bearish: A market sentiment characterized by pessimism and the anticipation of falling prices.

1️⃣2️⃣ Resistance is a price level where selling pressure is typically stronger, preventing the price from rising further.

1️⃣3️⃣ Support is a price level where buying pressure tends to be stronger, preventing further price declines.

1️⃣4️⃣ Going Long: Purchasing a currency pair with the expectation that its value will appreciate.

1️⃣5️⃣ Going Short: Selling a currency pair with the expectation that its value will fall.

1️⃣6️⃣ Liquidity refers to the ease with which an asset or market can be bought or sold without substantially affecting its price.

1️⃣7️⃣ Volatility: The measure of the market’s price fluctuations over a given period. Greater volatility indicates greater price fluctuations.

1️⃣8️⃣ Carry Trade: A trading strategy in which a trader borrows funds in a currency with a low-interest rate and invests them in a higher currency with a higher interest rate to profit from the interest rate differential.

1️⃣9️⃣ Fundamental Analysis: Examining economic indicators, geopolitical events, and market news to determine a currency’s intrinsic value and potential future movements.

2️⃣0️⃣ Technical Analysis: The study of historical price patterns, charts, and indicators to identify potential trading opportunities and forecast price movements in the future.

Understanding Forex Charting (with examples)

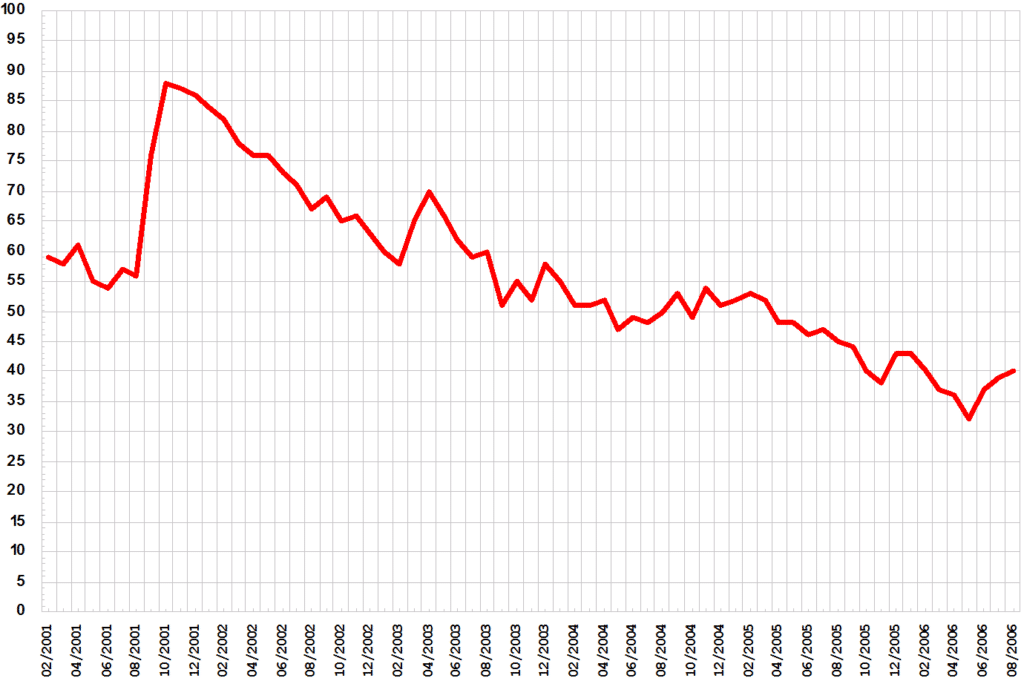

Forex charting is a crucial tool for forex traders to understand the movements of different currency pairs and make trading decisions based on that information. Traders use several charts, but the three most common are line charts, bar charts, and candlestick charts.

Line Charts

Line charts are the simplest type of chart. They are formed by drawing a line from one closing price to the next. Over time, these lines form a graph that gives traders a simplified view of the currency pair’s price movement.

However, the line chart doesn’t give information about the price movements within the trading period; it only shows closing prices.

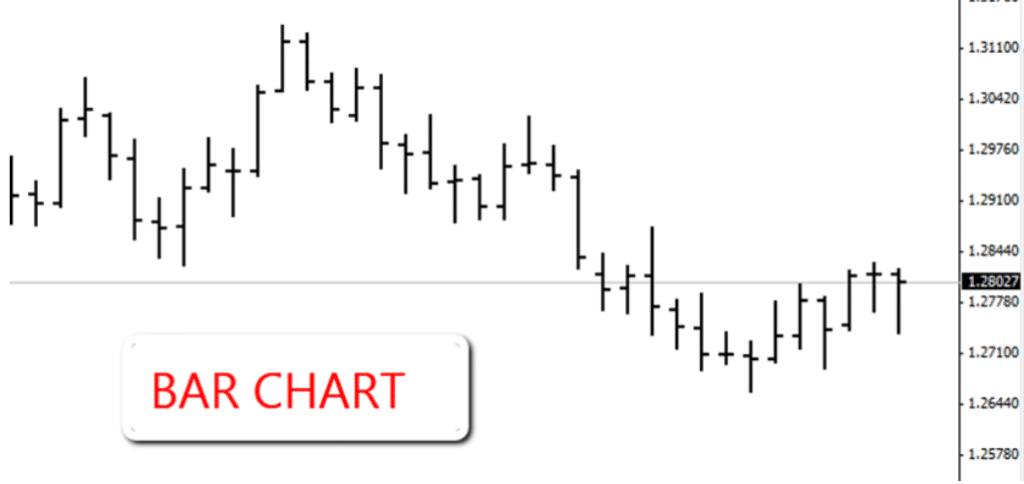

Bar Charts

Bar charts are more complex. Each “bar” in a bar chart represents a specific period – an hour, a day, a week, or any other period. The top of the bar shows the highest price for that period, and the bottom shows the lowest price.

Candlestick Charts

Candlestick charts are comparable to bar charts but present data slightly differently. The area between the opening and closing prices is represented by the “real body” of the “candlestick.”

If the real body is filled (usually coloured), the closing price is lower than the opening price. The closing price is higher if it is empty (or a different colour).

The thin lines from the top and bottom of the real body represent the highest and lowest prices during that period and are called “shadows” or “wicks.”

Effective Risk Management for Cameroon Forex Traders

Effective risk management is crucial for forex traders in Cameroon to protect their capital and ensure long-term success. Here are key strategies and principles for managing risk effectively:

By implementing effective risk management techniques, forex traders in Cameroon can mitigate potential losses, protect their capital, and create a solid foundation for consistent profitability.

Remember, successful trading is not just about making profits but also about managing risk effectively.

Best Forex Strategies for Cameroon Traders Revealed

For forex traders in Cameroon, implementing effective trading strategies is crucial for navigating the dynamic and highly liquid forex market. A well-defined strategy helps traders make informed decisions, manage risk, and increase the likelihood of consistent profitability.

These strategies encompass various approaches, including technical analysis, fundamental analysis, and risk management techniques. By understanding and implementing these strategies, Cameroon traders can enhance their trading skills and overall success in the forex market.

Trend Trading

This strategy is based on the assumption that the current direction of the currency price will continue. It applies to all markets, but its high liquidity and tendency to develop trends make it ideal for Forex trading.

Trend traders may use moving averages or the MACD indicators to determine the trend’s direction and enter trades.

Scalping

Scalping is a trading strategy in which traders execute numerous small trades to profit from small price fluctuations. Scalping can be intense and requires close market observation. Typically, it is performed on 1-minute or 5-minute time frame charts.

Swing Trading

Swing trading entails holding positions for several days to weeks to profit from price fluctuations or “swings.” This strategy is appropriate for traders who cannot monitor their charts throughout the day but can devote a few hours per night to market analysis.

Position Trading

This is a long-term trading strategy in which traders hold positions for weeks, months, or years. Position traders typically rely on fundamental analysis and technical chart patterns and may only trade a handful of times yearly.

Breakout Trading

Trading on a currency pair’s break above or below resistance is an example of “breakout trading,” in which a position is entered as early as possible in a trend. If the trend reverses, traders will place a stop loss below the breakout point.

Spot, Forwards, and Futures in Forex Trading

Spot, forwards, and futures are common trading instruments on the foreign exchange market with distinct functions and characteristics. Here is a description of each of these financial instruments for Cameroon traders.

Spot Market

The spot market is the most fundamental and widely traded form of forex trading. It is the exchange of currencies at the current market price, also known as the spot price.

In spot trading, on average, transactions are settled “on the spot” within two business days. It is the primary market for buying and selling currencies for immediate delivery.

Key Attributes

Benefits for Cameroon Traders

Spot trading provides quick access to the foreign exchange market, allowing Cameroonian traders to take advantage of short-term trading opportunities and convert currencies efficiently.

Forwards Market

Forwards are agreements between two parties to exchange currencies on a future date at a predetermined price (forward rate).

These contracts are traded on the over-the-counter (OTC) market and are tailored to the specific needs of buyers and sellers. Unlike spot trading, forwards allow traders to lock in exchange rates for future transactions.

Key Attributes

Benefits for Cameroon Traders

Forwards can be advantageous for Cameroonian traders who need to hedge against future currency fluctuations or have specific foreign exchange needs for business operations or international transactions.

Futures Market

Futures contracts are standard agreements to buy or sell currencies at a predetermined price (future price) on a future date.

These contracts are traded on regulated exchanges like the Chicago Mercantile Exchange (CME) and have predetermined contract sizes and expiration dates. Institutional traders and speculators are the primary users of futures contracts.

Key Attributes

Benefits for Cameroon Traders

Individual retail traders in Cameroon may have limited access to trading forex futures. Still, an understanding of futures contracts can shed light on the larger forex market and the role of institutional participants.

What is Forex Brokers?

Forex brokers grant traders access to a trading platform to buy and sell foreign currencies.

Foreign exchange (forex) trading requires access to the right currency pairs (the two currencies being exchanged), the best execution, and reliable financial news and analytics.

Forex brokers are the gateway for forex traders to participate in the market, offering services designed to assist traders in making these transactions.

What is the Role of a Forex Broker?

The primary role of a forex broker is to facilitate trades by providing traders access to the foreign exchange market. Here are some specific roles they play.

Access to the Forex Market

The forex market is an interbank market comprised of a network of banks trading with each other. Individual traders cannot directly access this network, but forex brokers bridge this gap by offering retail traders access to the currency market.

Provide Leverage

Forex brokers provide leverage, allowing traders to trade larger positions than their account balance would ordinarily permit. This amplifies potential profits but also potential losses.

Trading Platforms

Forex brokers provide platforms for executing trades. These platforms have various tools to help traders analyze the market, such as real-time price feeds, charting tools, news feeds, and more.

Education and Support

Many brokers also offer educational resources to help traders understand the market and improve their trading skills. This can include webinars, e-books, articles, and more. They also provide customer support to assist with technical issues or questions about trading.

How do Forex Brokers Make Money?

Forex brokers make money primarily in the following ways:

Ask and Bid Price in Forex Trading

Ask and bid prices play an essential role in executing forex trades. Understanding the bid and ask prices is essential for Cameroonian traders so that they can assess the cost of executing trades and the potential impact on their profitability.

When selecting a broker, it is essential to consider the bid-ask spread, as tighter spreads can contribute to lower trading costs.

Ask Price

A trader can purchase a currency pair from a market maker or broker at the ask price, also known as the offer price.

It indicates the price at which the market is willing to exchange the base currency for the quote currency. The ask price is always greater than the bid price, constituting the upper portion of the bid-ask spread.

Bid Price

A trader may sell a currency pair to a market maker or broker at the bid price. It indicates the price the market is willing to sell the quoted currency in exchange for the base currency. The bid price is always less than the ask price, constituting the lower portion of the bid-ask spread.

Bid-Ask Spread

The difference between the ask and bid prices is known as the bid-ask spread. It is the cost associated with entering or exiting a trade.

The spread is typically expressed in pip increments and varies between currency pairs and brokers. A narrower spread indicates increased liquidity, whereas a wider spread may indicate decreased liquidity or increased market volatility.

Spread and Pips in Forex Trading

Spread and pips are essential forex trading terms that determine the cost of trading and indicate the liquidity and volatility of currency pairs. Understanding spread, and pips is crucial for Cameroonian traders, as it directly impacts their trading costs and potential profits.

Traders should evaluate the spreads offered by brokers and choose those with competitive spreads to optimize their trading outcomes.

Spread

In foreign exchange, the spread is the difference between the bid and ask prices. It represents the cost of trading and is typically expressed in basis points (pips). The spread is affected by market liquidity, volatility, and the pricing model of the broker.

Brokers may offer fixed or variable spreads, with variable spreads typically contracting during periods of high liquidity.

Pips

A pip, which is short for “percentage in point,” is the smallest unit by which the price of a currency pair can fluctuate. It represents the fourth decimal place for most currency pairs, excluding those involving the Japanese yen, for which it represents the second decimal place.

Pips enable traders to measure price fluctuations, calculate profits or losses, and assess the impact of the spread on their trades.

What is Day Trading?

Day trading is a popular forex strategy involving executing trades within the same day to capitalize on short-term price fluctuations. Day traders typically close all their positions before the market closes to avoid overnight exposure.

Here is a summary of day trading and its potential advantages and disadvantages for Cameroonian traders.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Day trading aims to capitalize on intraday price fluctuations, enabling traders to potentially generate quick profits from multiple trades conducted within a single day. | Day trading requires active monitoring of price movements and continuous market analysis, making it a time-intensive strategy that may not fit the schedules of all traders. |

| Since day traders close their positions before the market closes, they avoid overnight market risks, such as unanticipated news events or economic reports. | Increased Emotional Stress: The fast-paced nature of day trading can be mentally and emotionally taxing, necessitating self-discipline and the capacity to manage stress effectively. |

| Day traders receive immediate feedback on their trading decisions, allowing them to evaluate the efficacy of their strategies and make adjustments promptly. | Frequent trading can increase transaction costs due to spreads, commissions, and fees, eroding potential profits. |

| Day trading typically involves smaller position sizes, necessitating less margin than longer-term trading strategies. | Day trading focuses primarily on short-term price fluctuations, which may limit opportunities in certain market conditions where longer-term trends dominate. |

Common Strategies

What is Swing Trading?

Swing is a trading strategy aiming to capitalize on shorter-term market movements. In contrast to day traders, swing traders typically hold positions for several days to several weeks.

Swing trading represents a compromise between the short-term intensity of day trading and the long-term commitment of position trading.

Cameroonian traders can capitalize on significant price fluctuations while providing greater flexibility and less time commitment than day trading.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Swing traders aim to capture significant price movements within a trend, allowing for greater profits than day trading. | Overnight Risks Swing traders hold positions overnight, exposing them to market gaps or unfavourable news events outside trading hours. |

| Swing trading requires less time and constant monitoring than day trading, making it suitable for traders with limited time or those favouring a less intensive approach. | Possibility of Missed Opportunities Swing trading necessitates patience and waiting for favourable trade setups, leading to traders missing some opportunities for short-term trading. |

| Increased Market Exposure Swing traders can profit from medium-term trends and market fluctuations, allowing them to participate in various market conditions. | Longer Drawdown Periods: During market consolidations or trend reversals, swing traders may experience longer drawdown periods, which can test their patience and resiliency. |

| Swing trading allows less stressful decision-making because traders have more time to analyze the market and make well-informed decisions. |

Common Strategies

What is Scalping in Forex Trading?

Scalping is a forex trading strategy that profits rapidly from small price fluctuations. Scalpers seek to enter and exit trades within seconds to minutes, capitalizing on short-term market volatility.

Scalping may be suitable for seasoned, disciplined Cameroonian traders who are comfortable with fast-paced trading and have access to cutting-edge trading technology.

It provides the opportunity for frequent small profits, reduced exposure to overnight risks, and independence from long-term market trends. However, scalping requires a high skill level, rigorous risk management, and emotional control in a high-pressure trading environment.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Scalping aims to capitalize on small price fluctuations, enabling traders to amass profits through a high volume of trades. | High Trading Costs: Frequent trading and tight stop-loss levels can lead to higher transaction costs due to spreads and commissions, harming overall profitability. |

| Scalpers typically close their positions before the end of the trading day, thereby reducing their exposure to overnight risks. | Scalping necessitates constant monitoring of price fluctuations and prompt decision-making, requiring traders to focus intensely and concentrate. |

| Scalping focuses on short-term price fluctuations, limiting traders’ exposure to unexpected market events or prolonged trends. | Technology and Execution Speed: Scalping frequently relies on fast and dependable trade execution, necessitating sophisticated trading platforms and robust internet connections. |

| Scalping strategies can be designed to profit from rising and falling markets, as they depend on short-term price volatility rather than long-term trends. | Emotional Obstacles: Due to the rapid pace of trading and the need to make quick decisions, scalping can induce stress and emotional pressure. |

Common Strategies

Base and Quote Currencies in Forex Trading

In forex trading, the base and quote currencies are fundamental concepts that determine the value and pricing of currency pairs.

Understanding these terms is essential for determining which currency is purchased or sold in a pair. If a trader believes the base currency will gain value relative to the quoted currency, they will buy the currency pair.

In contrast, if they anticipate that the base currency will weaken, they will sell the currency pair. Analyzing the economic factors and market conditions affecting the base and quote currencies is essential to make informed trading decisions.

Here is a description of the base and quote currencies and their significance to Cameroonian traders.

Base Currency

The base currency is the currency that appears first in a currency pair. It signifies the currency being purchased or sold. Traders evaluate the relative value of the base currency and the quote currency. In the EUR/USD pair, the Euro serves as the base currency.

Quote Currency

The quote currency, the counter currency, is the second currency listed in a currency pair. It serves as the medium through which the value of the base currency is quoted.

When trading a currency pair, the quote currency indicates how much of that currency is necessary to purchase one unit of the base currency. The US dollar is the quoted currency in the EUR/USD currency pair.

The Importance of Market Sentiment in Forex Trading

The sentiment of traders and investors towards a particular financial market is called market sentiment. It reflects the collective psychological state of market participants and influences their purchasing and selling decisions.

Understanding market sentiment is crucial for Cameroonian traders, as it can significantly affect price fluctuations and trading outcomes. The importance of market sentiment in forex trading is elaborated below.

The Influence on Price Movement

In the forex market, market sentiment is crucial in determining price movements. If most market participants are optimistic about a currency, this can exert upward pressure on its value. In contrast, negative sentiment can result in a decline in pressure.

Traders can anticipate potential price reversals or trends by comprehending and evaluating market sentiment.

Impact on Fundamental Analysis

Market sentiment can influence fundamental analysis by supporting or contradicting economic indicators and news releases.

Positive sentiment can amplify positive economic data, whereas negative sentiment can obscure good news. To obtain a comprehensive market view, traders must consider market sentiment and fundamental analysis.

The Role it Plays in Technical Analysis

Additionally, market sentiment can influence technical analysis. Traders frequently employ technical indicators and chart patterns to identify potential trading opportunities. However, market sentiment can either confirm or disprove these signals.

For instance, if the market sentiment is extremely bullish, it may increase the reliability of bullish technical signals.

Risk Management

Market sentiment can impact risk management decisions. Extreme market sentiments, such as extreme optimism or excessive fear, can result in irrational market behaviour and increased volatility.

Therefore, Cameroonian traders must exercise caution and modify their risk management strategies to account for the increased market volatility.

The Effects of Leverage on Forex Trading

Leverage is a potent instrument that enables traders to control larger market positions with less capital. Even though leverage can magnify potential profits, it carries significant risks.

By understanding the effects of leverage, implementing sound risk management strategies, and choosing an appropriate leverage level, Cameroon traders can optimize their trading performance while safeguarding their trading capital.

Multiplies Profits and Losses

Leverage magnifies both profit potential and loss potential. By utilizing leverage, traders can open positions larger than their available funds. Profits are multiplied if a transaction goes in their favour. Nevertheless, if the trade goes against them, their losses will also be magnified.

Traders must exercise caution and implement stringent risk management practices to mitigate leverage risks.

How it Affects Capital Requirements and Margin

In forex trading, leverage influences the capital requirement and margin. Less capital is required to open a position as the leverage ratio increases.

However, it is essential to note that lower margin requirements result in higher leverage, which increases the risk of potential losses. Based on their risk tolerance and trading strategy, traders should consider the optimal leverage level.

Overall Flexibility and Creating Trading Opportunities

Leverage grants traders greater flexibility and access to more trading opportunities. With lower capital requirements, traders can participate in larger positions and trade multiple currency pairs simultaneously.

This flexibility permits Cameroonian traders to diversify their portfolios and experiment with different trading strategies.

Understanding Risk Management and Margin Calls

Effective leverage management is essential for risk management. If trades go against expectations, excessive leverage can rapidly deplete trading accounts.

When account equity falls below the required margin level, margin calls may be triggered, resulting in forced position closure. To avoid margin calls and account liquidation, traders in Cameroon should evaluate their risk tolerance and set appropriate leverage levels.

The Importance of Education and Demo Accounts

Given the potential risks associated with leverage, Cameroonian traders must educate themselves on leverage and its effect on trading outcomes.

Demo trading platforms offer an excellent opportunity to practice trading with virtual funds and experience leverage in a risk-free setting.

This enables traders to familiarise themselves with the dynamics of leveraged trading and develop risk management strategies suitable for the situation.

Regulatory Considerations

Availability of leverage may vary depending on Cameroon’s regulatory framework. Regulatory bodies may limit leverage ratios to protect traders from excessive risk.

Cameroonian traders must comprehend and adhere to the leverage regulations established by the relevant authorities.

MetaTrader 4 VS MetaTrader 5

| Features | 💻 MetaTrader 4 | 🖥️ MetaTrader 5 |

| 🌐 Market Focus | Primarily Forex | Multi-asset |

| 📱 User Interface | Simpler, user-friendly | More complex, advanced |

| ⏰ Timeframes | 9 | 21 |

| 🏦 Order Types | 3 – market, limit, and stop | 6 – market order, limit order, stop order, stop limit order, buy stop, and sell |

| 📊 Technical Indicators | 30 built-in indicators | 38 built-in indicators |

| 📈 Graphical Objects | 31 | 44 |

| ⚙️ Automated Trading | Yes (EAs) | Yes (EAs with built-in tester) |

| 👥 Programming Language | MQL4 | MQL5 |

| ⚖️ Offers Market Depth? | None | Yes |

| 💧 Hedging | Yes | Yes |

Best Cameronian Forex Brokers

Cameroon’s Best MT4 Forex Broker

Overall, HFM is the best MT4 forex broker in Cameroon. HFM allows Cameroonians to open real and demo accounts on the MT4 mobile, web, and desktop platforms. Furthermore, when using MT4, traders can expect 0.0 pip spreads on major instruments across asset classes.

Min Deposit 0 USD / 0 XAF Regulators FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA Trading Desk MetaTrader 4 and MetaTrader 5 Crypto Yes Total Pairs 50+ Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Cameroon’s Best MT5 Forex Broker

Overall, Pepperstone is the best MetaTrader 5 forex broker. Pepperstone welcomes Cameroonian traders and provides multi-account access to the powerful, innovative MetaTrader 4.

Cameroonians can use this platform to optimize their trading strategies and perform sophisticated back-testing before entering a live market.

Min Deposit 0 USD / 0 XAF Regulators ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB Trading Desk MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, Duplitrade Crypto Yes Total Pairs 90+ Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Forex Broker for Beginner Cameronians

Overall, AvaTrade is the best forex broker for beginners. AvaTrade provides the most comprehensive educational materials to help beginners. AvaTrade also provides a demo account and helpful and friendly customer support.

Min Deposit 100 USD / 59,837 XAF Regulators CBI, BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA Trading Desk AvaTradeGO, AvaOptions, AvaSocial, MT4, MT5, DupliTrade, ZuluTrade Crypto Yes Total Pairs 55+ Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Best Low Minimum Deposit Cameronian Forex Brokers

Overall, FBS is the best Low Minimum Deposit Forex Broker in Cameroon. FBS enables Cameroonians to begin trading with capital as low as 6100 XAF. FBS provides some of the best mobile trading technologies and the advantage of high leverage up to 1:3000.

Min Deposit 1 USD / 603 XAF Regulators IFSC, CySEC, ASIC Trading Desk MT4, MT5, FBS Trader, CopyTrade Platform Crypto Yes Total Pairs 36 Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Best Islamic Brokers in Cameroon

Overall, OANDA is the best Islamic / Swap-Free forex broker in Cameroon. OANDA offers three retail trading accounts, one specifically designed for Islamic trading. OANDA provides award-winning trading platforms and a diverse range of tradable markets.

Min Deposit 0 USD / 0 XAF Regulators FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA Trading Desk MetaTrader 4, OANDA Platform, TradingView Crypto No Total Pairs 68 Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Lowest Spread Cameronian Forex Brokers

Overall, XM is the best, lowest-spread forex broker in Cameroon. XM provides cutting-edge trading technology and a wide range of tradable instruments. XM has its app and excellent trade execution, as well as a variety of educational materials and research tools.

Min Deposit 5 USD / 2,991 XAF Regulators FSCA, IFSC, ASIC, CySEC, DFSA Trading Desk MetaTrader 4, MetaTrader 5, XM Mobile App Crypto Yes Total Pairs 50 Islamic Account Yes Trading Fees Low Account Activation 24 Hours

VIX 75 Forex Brokers in Cameroon

Overall, IC Markets is the best Volatility 75 / VIX 75 forex broker in Cameroon. IC Markets is the most reputable and largest true ECN broker, providing Cameroonians access to the Volatility index.

IC Markets provides several advanced trading technologies that provide a competitive advantage to Cameroonians.

Min Deposit 200 USD / 119,675 XAF Regulators ASIC, CySEC, FSA in Seychelles, and SCB Trading Desk MetaTrader 4, MetaTrader 5, cTrader Crypto Yes Total Pairs 75 Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Cameroon’s Best NDD Forex Broker

Overall, Exness is the best NDD forex broker in Cameroon. Exness is one of the best No-Dealing Desk brokers, with the fastest trade execution times and the most competitive pricing in the industry.

Exness only works with the world’s best and most dependable liquidity providers, such as banks and hedge funds. Therefore, Cameroonian traders can expect the best execution and minimal slippage.

Min Deposit 10 USD / 5,983 XAF Regulators FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA Trading Desk MT4, MT5, Exness Terminal, Exness Trader app Crypto Yes Total Pairs 100+ Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Frequently Asked Questions

What is the minimum capital required to start forex trading in Cameroon?

The minimum capital required to start forex trading in Cameroon varies among brokers but can range from as low as $1 to several hundred dollars.

Who regulates forex trading in Cameroon?

Yes, forex trading in Cameroon is regulated by regulatory bodies such as the Financial Markets Commission (CMF) and the Bank of Central African States (BEAC).

Furthermore, CoSUMAF, the Commission de Surveillance du Secteur Financier de l’Afrique Centrale, supervises investment businesses, deposit-taking institutions, and other financial institutions in Cameroon.

What are the trading hours for forex in Cameroon?

Forex markets operate globally, so trading hours in Cameroon typically overlap with the major trading sessions in different time zones, providing opportunities for trading 24 hours a day, from Monday to Friday.

What are the most popular currency pairs for forex trading in Cameroon?

The most popular currency pairs for forex trading in Cameroon include EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

What are the risks involved in forex trading?

Forex trading carries risks, including the potential for financial losses. Understanding and managing risks through proper risk management techniques and strategies is important.

What trading strategies are suitable for beginners in Cameroon?

For beginners in Cameroon, starting with simpler strategies, such as trend following or breakout strategies, is recommended before advancing to more complex techniques.

How can I choose the best forex broker in Cameroon?

When choosing a forex broker in Cameroon, consider factors such as regulation, trading costs, available trading platforms, customer support, and the broker’s reputation in the industry.

Can I trade forex using a mobile device in Cameroon?

Yes, many forex brokers offer mobile trading platforms, allowing Cameroon traders to access the forex market and trade using their smartphones or tablets.

Are there any forex educational resources available in Cameroon?

Yes, there are various educational resources available, including online courses, webinars, tutorials, and trading guides that can help traders in Cameroon enhance their forex trading knowledge and skills.

How can I manage risk in forex trading?

Risk management is crucial in forex trading. Traders should implement strategies such as setting stop-loss orders, diversifying their portfolio, and using appropriate position sizing to manage risk effectively.