Markets.com Review

Overall Markets.com is considered low-risk, with an overall Trust Score of 98 out of 100. They are licensed by two Tier-1 Regulators (high trust), two Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). In addition, the broker offers Cameroonian traders five retail trading accounts, namely a Basic, Classic, Silver, Gold, and Platinum Account.

- Kayla Duvenage

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Min Deposit

100 USD / 59,837 XAF

Regulators

ASIC, CySEC, FSCA, FCA, BVI FSC

Trading Desk

MarketsX, Marketsi, MetaTrader 4, MetaTrader 5, MarketsX App

Crypto

Yes

Total Pairs

97

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overview

Markets.com was founded in 2008 and is a subsidiary of Finalto, which is a subsidiary of Playtech PLC, listed on the London Stock Exchange Main Market and is a member of the FTSE 250 Index.

Markets.com is a well-known and licensed broker that offers a diverse choice of trading products across a variety of markets. Award-winning trading solutions for PC and mobile devices allow you to trade different assets in competitive, fair, transparent trading environments.

The broker is a terrific broker for traders looking for a comprehensive and reputable online platform with a wide range of account options and features.

This Markets.com review for Cameroon will provide local retail traders with the details that they need to consider whether Markets.com is suited to their unique trading objectives and needs.

MT4, MT5, and MarketsX platforms are supported. The broker is headquartered in South Africa and regulated by ASIC, CySEC, FSCA, FCA, and BVI FSC.

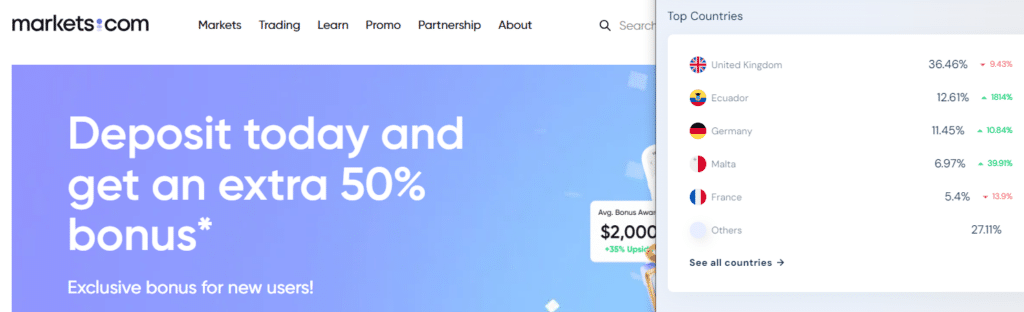

Distribution of Traders

Most of Markets.com’s market share is concentrated in these areas:

➡️️ United Kingdom – 36.46%

➡️️ Ecuador – 12.61%

➡️️ Germany – 11.45%

➡️️ Malta – 6.97%

➡️️ France – 5.4%

Popularity among traders

Markets.com is regulated in South Africa and offers its services to African traders, making it one of Cameroonian traders’ top 50 Forex and CFD brokers.

What is Markets.com known for?

The broker is known for being a comprehensive online trading platform that offers access to a wide range of financial instruments, including forex, stocks, commodities, and cryptocurrencies.

Is Markets.com suitable for both beginners and experienced traders?

The broker caters to both beginners and experienced traders. The platform offers educational resources for those new to trading while providing advanced features for experienced traders.

At a Glance

| 🏛️ Headquartered | The British Virgin Islands |

| 🏛️ Local office in Yaoundé? | No |

| 👍 Accepts Cameroonian Traders? | Yes |

| 📅 Year Founded | 2008 |

| 📱 Cameroonian Office Contact Number | None |

| ⚖️ Regulation | ASIC, CySEC, FSCA, FCA, BVI FSC |

| 🔎License Number | Cyprus (Safecap Investments) – 092/08 British Virgin Islands (Finalto) – SIBA/L/14/1067 South Africa (Finalto Pty Ltd) – 46860 South Africa (Safecap Investments Limited) – 43906 United Kingdom (Finalto Trading Ltd) – 607305 Australia (Finalto) – ABN 82158641 |

| ⚖️ BEAC Regulation | None |

| ✴️ Regional Restrictions | The United States, Japan, Canada, Belgium, Israel, New Zealand, Russia, Hong Kong, and several other regions |

| ☪️ Islamic Account | Yes |

| 📈 Demo Account | Yes |

| 📈 Retail Investor Accounts | 5 |

| 🚀 Offers a XAF Account? | No |

| 💻 Dedicated Cameroonian Account Manager? | No |

| 📈 Maximum Leverage | Retail – 1:30 Professional – 1:300 |

| 📈 Leverage Restrictions for Cameroon? | Yes, based on trading experience |

| 💳 Minimum Deposit | 100 USD / 59,837 XAF |

| 💳 XAF Deposits Allowed? | No |

| 💰 Active Cameroonian Trader Stats | Unknown |

| 👥 Active Markets.com customers | 4.3 million+ |

| 💰 Cameroon Daily Forex Turnover | $5 trillion+ (Overall Forex Globally) |

| 💳 Deposit and Withdrawal Options | Bank Wire Transfer Credit Card Debit Card Skrill Neteller PayPal Local Bank Transfer Ideal Sofort |

| 💰 Segregated Accounts in Cameroon | No |

| 💻 Trading Platforms | MetaTrader 4 MetaTrader 5 Markets.com |

| 💰 Tradable Assets | Forex Shares Commodities Indices Cryptocurrency ETFs Bonds IPO |

| 🌐 Markets.com USD/XAF Forex Pair? | No |

| 📈 Offers Cameroonian Stocks and CFDs | No |

| 👨💼 Languages supported on Website | English, Spanish, Thai, Vietnamese |

| 👥 Customer Support Languages | Multilingual |

| 👥 Customer Service Hours | 24/5 |

| 👥 Cameroon-based customer support? | No |

| 💰 Bonuses and Promotions for Cameroonians | Yes |

| ✴️ Education for Cameroonian beginners | Yes |

| 📊 Proprietary trading software | Yes |

| 💰 Most Successful Cameroonian Trader | Unknown |

| ✔️ Is Markets.com a safe broker for Cameroonian? | Yes |

| ✔️ Rating for Markets.com in Cameroon | 7/10 |

| ✔️ Trust score for Markets.com in Cameroon | 98% |

| 🎉 Open an account | Open Account |

Regulation and Safety of Funds

The broker is not currently regulated by the Bank of Central African States (BEAC). However, They are well-regulated by several reputable market regulators in other countries

Security while Trading

The broker prioritizes security and ensures the safety of traders’ funds through various measures across different regulatory jurisdictions:

ASIC (AU):

CySEC (EU):

FCA (UK):

FSC (GLOBAL):

FSCA (ZA):

Is Markets.com a regulated platform?

Yes, they are a regulated online trading platform. They are authorized and regulated by reputable financial authorities, ensuring that they comply with stringent regulatory standards.

How does Markets.com ensure the safety of user funds?

The broker prioritizes the safety of user funds by implementing robust security measures, including encryption and segregation of client funds.

Awards and Recognition

Markets.com does not currently give any information on its awards and honours, save from the “Best Trading Platform” award from FxScouts in 2020.

Markets.com Account Types and Features

Basic Account

💰 Minimum Deposit Requirement 100 USD / 59,837 XAF

💵 Daily Analysis Offered Yes

📱 Desktop and Mobile Trader Offered Yes

📈 Access to Video Tutorials Yes

💬 Chat Customer Support Yes

💻 Access to Webinars Yes

👥 Demo Account Available? Yes

🌐 Negative Balance Protection Yes

💳 Fee Conversions Applied Yes

✴️ Option to Use One-Click Trading Yes

👨💼 Recommendations from Analysts Yes

📊 Stop-Out 50%

🎉 Open An Account Open Account

Classic Account

💰 Minimum Deposit Requirement 1,000 USD / 604,117 XAF

💵 Daily Analysis Offered Yes

📱 Desktop and Mobile Trader Offered Yes

📈 Access to Video Tutorials Yes

💬 Chat Customer Support Yes

💻 Access to Webinars Yes

👥 Demo Account Available? Yes

🌐 Negative Balance Protection Yes

💳 Fee Conversions Applied Yes

✴️ Option to Use One-Click Trading Yes

👨💼 Recommendations from Analysts Yes

📊 Stop-Out 50%

🎉 Open An Account Open Account

Silver Account

💰 Minimum Deposit Requirement 2,500 USD / 1,510,294 XAF

💵 Daily Analysis Offered Yes

📱 Desktop and Mobile Trader Offered Yes

📈 Access to Video Tutorials Yes

💬 Chat Customer Support Yes

💻 Access to Webinars Yes

👥 Demo Account Available? Yes

🌐 Negative Balance Protection Yes

💳 Fee Conversions Applied Yes

✴️ Option to Use One-Click Trading Yes

👨💼 Recommendations from Analysts Yes

📊 Stop-Out 50%

🎉 Open An Account Open Account

Gold Account

💰 Minimum Deposit Requirement 25,000 USD / 15,102,942 XAF

💵 Daily Analysis Offered Yes

📱 Desktop and Mobile Trader Offered Yes

📈 Access to Video Tutorials Yes

💬 Chat Customer Support Yes

💻 Access to Webinars Yes

👥 Demo Account Available? Yes

🌐 Negative Balance Protection Yes

💳 Fee Conversions Applied Yes

✴️ Option to Use One-Click Trading Yes

👨💼 Recommendations from Analysts Yes

📊 Stop-Out 40%

🎉 Open An Account Open Account

Platinum Account

💰 Minimum Deposit Requirement 50,000 USD / 30,205,885 XAF

💵 Daily Analysis Offered Yes

📱 Desktop and Mobile Trader Offered Yes

📈 Access to Video Tutorials Yes

💬 Chat Customer Support Yes

💻 Access to Webinars Yes

👥 Demo Account Available? Yes

🌐 Negative Balance Protection Yes

💳 Fee Conversions Applied Yes

✴️ Option to Use One-Click Trading Yes

👨💼 Recommendations from Analysts Yes

📊 Stop-Out 30%

🎉 Open An Account Open Account

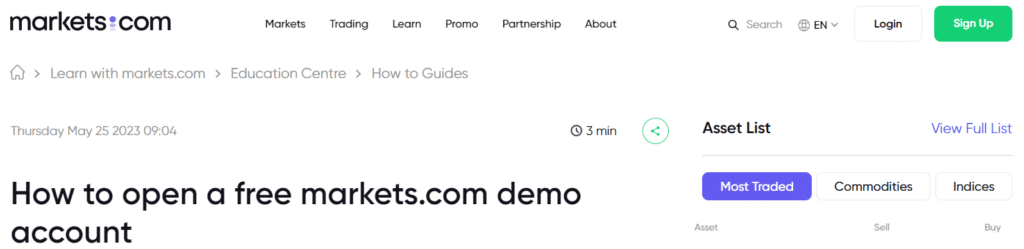

Demo Account

The broker offers traders the opportunity to open a unique Demo Account, providing them with a valuable learning experience to familiarize themselves with the platform’s functionality and gain insights into market dynamics.

The Demo Account is preloaded with a substantial virtual fund of 10,000 USD, allowing traders to practice trading strategies and explore the platform’s features without risking real money.

While the default duration of the demo account is 30 days, traders can request an extension if they require additional time for practice.

Moreover, the Demo Account is fully compatible with mobile devices, enabling traders to learn and trade seamlessly across multiple devices, enhancing convenience and accessibility.

Islamic Account

Islamic Sharia law, which forbids the accrual of interest on money deposited into the account, is followed by the Islamic account, also known as a swap-free trading account.

Additionally, payments must be made immediately, which necessitates transferring money from one account to another as soon as the transaction is finished and fully paid for.

The spreads traders can anticipate while using an Islamic account with the broker vary on several variables, including the financial instrument being traded, the market environment on the day of trading, and others. For EUR/USD, Markets.com’s typical spreads begin at 0.6 pips.

Over 8,000 tradeable products, ranging over multiple asset classes, are available to traders, giving them access to a wide range of trading opportunities on a worldwide scale.

What types of accounts are offered?

The broker offers five retail trading accounts, namely a Basic, Classic, Silver, Gold, and Platinum Account.

What features distinguish different account types on Markets.com?

The account types come with distinct features such as varying leverage, spreads, and additional services.

How to open an Account

To register an account with Markets.com, Cameroonian traders can follow these easy steps:

Step 1 – Click the “Create Account” button.

Go to Markets.com and click on “Create Account” in the top right corner.

Step 2 – Fill Out Your Details

You must provide basic personal information, such as your name, email address, phone number, and country of residence.

Markets.com Vs SuperForex Vs IG – Broker Comparison

| Markets.com | SuperForex | IG | |

| ⚖️ Regulation | ASIC, CySEC, FSCA, FCA, BVI FSC | None | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA |

| 📱 Trading Platform | Markets.com MetaTrader 4 MetaTrader 5 | MetaTrader 4 SuperForex App | MetaTrader 4 IG Platform ProRealTime (PRT) L2 Dealer FIX API |

| 💰 Withdrawal Fee | No | Yes | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 100 USD / 59,837 XAF | 1 USD / 604 XAF | 0 USD / 0 XAF |

| 📈 Leverage | 1:300 | 1:2000 | 1:30 (Retail, EU, UK) 1:222 (Professional) |

| 📊 Spread | From 0.6 pips | From 0.0 pips | From 0.1 pips DMA |

| 💰 Commissions | Spread only | From 0.013% | From 0.10% |

| ✴️ Margin Call/Stop-Out | 50%/30% | 80%/40% | 100%/50% |

| ✴️ Order Execution | Instant, Market | Instant, Market | Market |

| 💳 No-Deposit Bonus | No | Yes | No |

| 📊 Cent Accounts | No | Yes | No |

| 📈 Account Types | Basic Account Classic Account Silver Account Gold Account Platinum Account | Standard Account Swap-Free Account No Spread Account Micro Cent Account Profi STP Account Crypto Account ECN Standard Account ECN Standard Mini Account ECN Swap-Free Account ECN Swap-Free Mini Account ECN Crypto Account | CFD/DMA Trading Account Limited Risk Trading Account Options Trading Account Turbo24 Trading Account Share Dealing Account Spread Betting Account Swap-Free Trading Account |

| ⚖️ BEAC Regulation | No | No | No |

| 💳 XAF Deposits | No | Yes | No |

| 📊 XAF Account | No | Yes | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 5 | 11 | 7 |

| ☪️ Islamic Account | Yes | Yes | Yes, Dubai |

| 👉 Open an account | Open Account | Open Account | Open Account |

Min Deposit

100 USD / 59,837 XAF

Regulators

ASIC, CySEC, FSCA, FCA, BVI FSC

Trading Desk

MarketsX, Marketsi, MetaTrader 4, MetaTrader 5, MarketsX App

Crypto

Yes

Total Pairs

97

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Trading Platforms

Markets.com

The broker offers traders a professional-level trading environment on a user-friendly platform, enabling them to securely buy or sell financial instruments.

The platform aims to increase traders’ confidence and ability to make wise decisions by providing in-depth insights and analysis. The platform’s unique characteristics are:

MetaTrader 4

The broker offers the popular and user-friendly MetaTrader 4 (MT4) trading platform, which provides traders with a wide range of benefits.

With features such as Expert Advisors, micro-lots, hedging, and one-click trading, MT4 delivers everything traders expect from a trading platform and more.

Powered by Markets.com’s pricing, regulation, and infrastructure, traders can execute orders quickly, benefit from low spreads, and receive reliable support.

Key benefits of MT4 include:

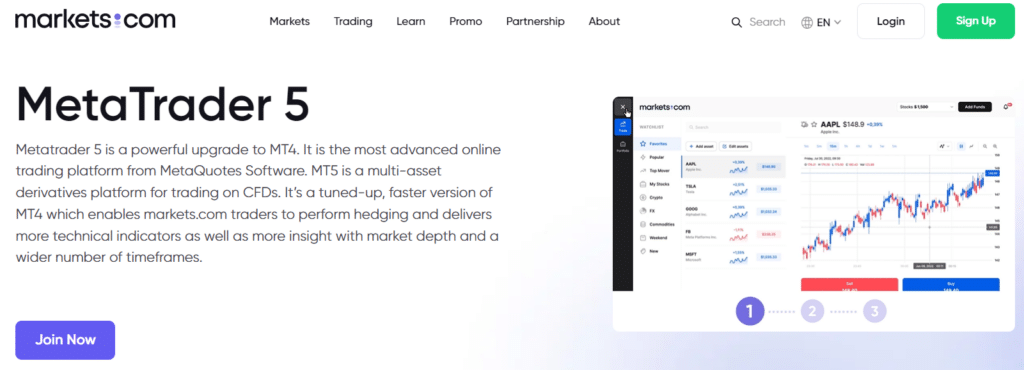

MetaTrader 5

The broker provides traders with MetaTrader 5 (MT5), a powerful and upgraded version of the MetaTrader 4 platform. Developed by MetaQuotes Software, MT5 is a cutting-edge online trading platform designed for multi-asset derivatives trading, particularly CFDs.

It offers enhanced functionality and advanced features to cater to the evolving needs of traders. Furthermore, key features and benefits of MT5 include:

What trading platforms are available?

The broker provides a selection of advanced trading platforms, including popular choices like MT4 or proprietary platforms developed by the broker.

Is mobile trading supported?

Yes, the broker supports mobile trading through dedicated apps compatible with both Android and iOS devices.

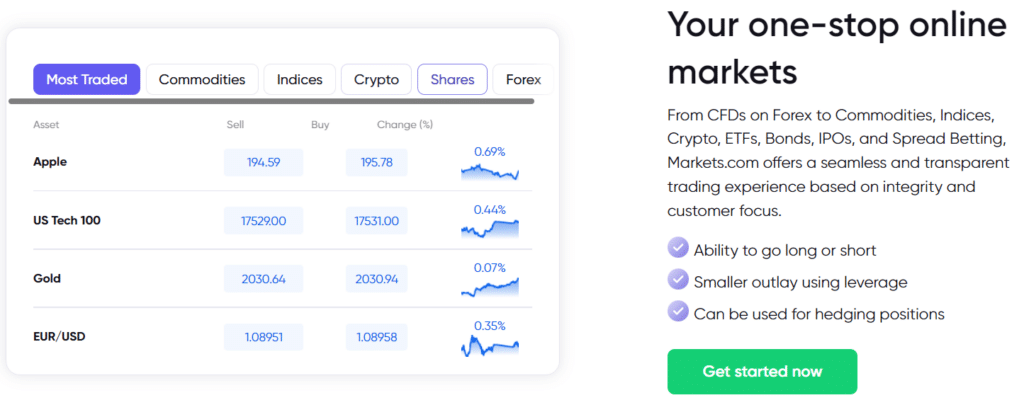

Range of Markets

Cameroonian traders can expect the following range of markets:

What financial instruments can I trade?

The broker offers a diverse range of tradable assets, including forex currency pairs, commodities, indices, stocks, and cryptocurrencies.

Are cryptocurrencies available for trading?

Yes, they support the trading of cryptocurrencies. Traders can engage in the dynamic crypto market, including popular digital assets like Bitcoin, Ethereum, and others.

Broker Comparison for Range of Markets

| Markets.com | easyMarkets | Global GT | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | Yes | Yes | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | Yes |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | Yes | Yes |

Min Deposit

100 USD / 59,837 XAF

Regulators

ASIC, CySEC, FSCA, FCA, BVI FSC

Trading Desk

MarketsX, Marketsi, MetaTrader 4, MetaTrader 5, MarketsX App

Crypto

Yes

Total Pairs

97

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Markets.com Trading and Non-Trading Fees

Spreads

The broker offers a distinctive service featuring competitive spreads tailored to market conditions, financial instruments, and specific trading times. Hence, Cameroonian traders who engage in leveraged trading through the broker need only focus on the spread, as the broker’s fee is already incorporated.

Commissions

They do not apply any commission fees for facilitating trades. Instead, the broker fee is included in the spread as a markup.

Overnight Fees, Rollovers, or Swaps

➡️ Instrument ➡️ Short Swap ➡️ Long Swap

EUR/USD -5.42945 pips -16.5668 pips

GBP/USD -9.44057 pips -15.841 pips

Brent Oil -0.81792 pips -2.99903 pips

XAU/USD -14.228 pips -52.169 pips

XAG/USD -1.73592 pips -6.36503 pips

US NASDAQ 100 -15.4783 pips -216.697 pips

VIX -0.04122 pips -0.57711 pips

EURO BUND ETF -1.3903 pips -1.8191 pips

BTC/USD -12% -25%

Deposit and Withdrawal Fees

The broker does not charge any fees for the deposit or withdrawal methods offered.

Inactivity Fees

Trading accounts are subject to inactivity fines if there is a continuous period of 90 days without any activity. In the event of inactivity, a fee of $10 will be imposed on the trading account until the balance reaches zero. Once the account balance reaches zero, the account will be closed.

Currency Conversion Fees

They implement currency conversion fees calculated as 0.6% multiplied by the conversion rate. These fees are levied when there is an exchange of currencies.

What are the trading fees on Markets.com?

They charge competitive trading fees in the form of spreads. Spreads vary depending on the asset being traded and market conditions.

Are there any non-trading fees?

Yes, they may charge non-trading fees, such as overnight financing fees for positions held overnight and inactivity fees if an account remains dormant.

Markets.com Deposits and Withdrawals

The broker offers Cameroonian traders the following deposit and withdrawal methods:

How long do Markets.com Deposits take?

The deposits can be instant or take a few days, depending on the payment method used when Cameroonians fund an account.

How long do Markets.com Withdrawals take?

Withdrawals are processed within 24 hours but could take several days, depending on the withdrawal method.

How to Deposit Funds

To deposit funds to an account, Cameroonian traders can follow these steps:

Step 1 – Log in to your account.

Visit the Markets.com website and log into your trading account.

Step 2 – Go to the deposit section.

Once logged in, find the “Deposit” or “Fund Your Account” section.

Step 3 – Select a deposit method.

Markets.com typically offers several deposit methods, including credit/debit cards, bank transfers, and online payment systems. Select the method that is most convenient for you.

Fund Withdrawal Process

To withdraw funds from an account with Markets.com, Cameroonian traders can follow these steps:

Step 1 – Log in to your account.

Go to the official Markets.com website and sign in with your trading credentials.

Step 2 – Go to the withdrawal section.

After you have successfully logged in, go to the withdrawals-only area. This area is usually located either in the “My Account” menu or on your account dashboard.

Step 3 – Select a withdrawal method.

Credit/debit cards, bank transfers, and several online payment systems are just a few of the withdrawal possibilities offered by Markets.com. Pick the approach that works best for you. Remember that certain brokers can insist that you use the same method for deposits and withdrawals.

Education and Research

The broker offers the following Educational Materials to Cameroonian traders:

The broker also offers Cameroonian traders the following additional Research and Trading Tools:

Does Markets.com provide educational resources for traders?

Yes, the broker offers a range of educational materials, including tutorials, webinars, and articles.

How can I stay updated on market research?

The broker provides regular market analysis and research updates. Traders can access these insights through the platform.

Bonuses and Promotions

The broker offers the following bonuses and promotions:

First Deposit Bonus

The broker presents the First-Time Deposit Bonus Program, available until December 31, 2023. Under this program, new clients can receive a 50% bonus on their initial deposit.

The maximum bonus per client is 2,000 ZAR / 66,000 ZAR. To qualify, clients must meet specific eligibility criteria, including being an individual and a new client while not being based in a banned jurisdiction or an employee of the company.

20% Deposit Bonus

The Deposit Bonus Program offered by Markets.com provides clients with a financial reward for their deposits during the promotional period until December 31, 2023.

Under this program, clients can receive a bonus based on their initial deposit, ranging from 20% of the deposit amount for deposits of USD 100 to USD 10,000. The maximum bonus that can be granted is USD 15,000.

To be eligible for the program, clients must meet certain conditions, including successful registration, KYC and AML compliance, and depositing within the promotional period.

Referral Bonus

At Markets.com, you can earn generous referral bonuses of up to $1,000 for each person you refer to the platform. It is a simple and rewarding way to make extra money while introducing your friends to online trading.

To get started, you must refer your friends to Markets.com by using their referral program. Once your friends sign up and make an initial deposit, you become eligible for a referral bonus. The best part is that the more your friends deposit, the higher your bonus will be.

For example, if your referee makes an initial deposit of $100 to $500, you can receive a bonus of $200 or a payment of $50. If their deposit falls within $500 to $1,000, your bonus increases to $500, or you can receive a payment of $150.

As the deposit amount rises, so do your potential earnings. Referees who deposit between $1,000 and $2000 can earn a bonus of $750 or a payment of $250. And if the referee’s deposit is $2,000 or more, you can receive an impressive bonus of $1000 or a payment of $375.

Does Markets.com offer any bonuses to traders?

The broker occasionally provides bonuses and promotions to its traders. These may include deposit bonuses, cashback offers, or other special promotions.

How can I participate in Markets.com promotions?

To participate in the promotions, traders can check the promotions section on the platform or contact customer support.

Affiliate Program Features

The comprehensive Affiliate Program offers the following features:

What features does the Affiliate Program offer?

The Affiliate Program provides a range of features, including competitive commission structures, real-time tracking tools, and marketing materials.

How can I track my performance in the Affiliate Program?

The Affiliate Program offers real-time tracking, allowing affiliates to monitor their performance instantly.

How to open an Affiliate Account

To register an Affiliate Account, Cameroonians can follow these steps:

Step 1 – Go to the Affiliates section.

Before signing up, carefully review the partnership offers, terms and conditions, Privacy Policy, and client agreement provided by Markets.com.

Step 2 – Click on the “Become a partner today” button.

Click on the “Become a partner today” banner to proceed.

Step 3 – Fill out the form.

Fill out the Affiliate account application by providing your username, first and last name, email address, and mobile phone number.

Customer Support

| ⏰ Operating Hours | 24/5 |

| 👥 Support Languages | Arabic, Afrikaans, Bulgarian, French, German, Greek, Italian, Spanish |

| 💬 Live Chat | Yes |

| 💻 Email Address | [email protected] |

| 📱 Telephonic Support | Yes |

| ✔️ The overall quality of Admirals Support | 4/5 |

How can I reach customer support?

The broker provides customer support through various channels, including live chat, email, and phone.

Is customer support available 24/5?

Yes, the broker offers customer support services 24 hours a day during the business week.

Corporate Social Responsibility

Markets.com provides no information regarding past, present, or future CSR projects or initiatives.

Verdict

Overall Markets.com is a robust platform for CFD trading, offering a user-friendly interface and prompt withdrawal processes.

It provides various financial instruments and account types, including a demo account preloaded with a substantial virtual fund for practice. However, it does not offer social or copy trading, and leverage restrictions are in place.

10 Best Forex Brokers in Cameroon

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Availability of over 2200 asset types to trade. | Geographic restrictions; not available to clients in the United States, Japan, Canada, Belgium, Israel, New Zealand, Russia, Hong Kong, and several other regions. |

| Comprehensive investor education tools that are accessible and informative. | Limited support over the weekends. |

| Commission-free trades and competitive spreads. | Proprietary trading platforms may not meet the needs of advanced traders. |

| Exceptional customer support and access to an expert trading team. | |

| Regulation by multiple reputable authorities, including ASIC, CySEC, and the FCA. |

you might also like: easyMarkets Review

you might also like: Admirals Review

you might also like: AvaTrade Review

you might also like: Exness Review

you might also like: FXPesa Review

Frequently Asked Questions

Does Markets.com provide educational resources for traders?

Yes, the broker offers a range of educational resources, including webinars, tutorial videos, and articles on various trading topics. These resources are designed to help traders of all levels improve their trading skills and knowledge.

Does Markets.com have Nasdaq 100?

Yes, the broker does offer trading on the Nasdaq 100 index. This lets traders speculate on the price movements of the top 100 non-financial companies on the Nasdaq Stock Market.

Does Markets.com offer mobile trading?

Yes, they offer a mobile trading platform on iOS and Android devices.

Is Markets.com Safe or a Scam?

The broker is considered safe as top-tier financial authorities such as CySEC, ASIC, FSCA, and FSC regulate it.

What trading platforms does Markets.com offer?

The broker provides its proprietary platform and the popular MetaTrader 4 and MetaTrader 5 platforms.

Is Markets.com regulated?

Yes, they are regulated by several financial authorities worldwide. This includes CySEC in Cyprus, FSCA in South Africa, ASIC in Australia, and the FSC in the British Virgin Islands.

How long does it take to withdraw from Markets.com?

The withdrawal time can vary depending on the withdrawal method used. Typically, withdrawals to credit or debit cards can take up to 5 business days, while bank transfers may take up to 7 business days. E-wallet withdrawals are usually processed within 24 hours.

Does Markets.com have VIX 75?

The broker offers VIXX as a CFD on indices, with spreads from 0.1 USD and leverage up to 1:25.

CFA Franc Forex Trading Accounts

CFA Franc Forex Trading Accounts

Scam Forex Brokers in Cameroon

Scam Forex Brokers in Cameroon