FBS Review

Overall FBS is considered an average risk, with an overall Trust Score of 75 out of 100. The broker is licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and one Tier-3 Regulator (low trust). They offer six retail trading accounts: Cent, Micro, Standard, Zero, ECN, Pro, and Crypto Account.

- Kayla Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

1 USD / 603 XAF

Regulators

IFSC, CySEC, ASIC

Trading Desk

MT4, MT5, FBS Trader, CopyTrade Platform

Crypto

Yes

Total Pairs

36

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overview

FBS is a regulated brokerage renowned for offering online trading in various Forex and CFD instruments spanning various asset classes. Furthermore, they are committed to providing traders with competitive conditions with tight spreads, minimal fees, and swift trade execution speeds.

Notably, the broker offers a leverage that can reach up to 1:3000, although this is subject to regional variations. The specific trading conditions one can expect are contingent upon the chosen account type, the selected instrument, and the trading volume.

The traders who will benefit most from the broker are likely those who appreciate low spreads (especially for scalping), those who want to trade with minimal risk (using the Cent account), and those who appreciate the flexibility of different account types to suit their trading strategy.

However, traders who require a wide variety of assets or are located in the EU may find some limitations with the broker.

Distribution of Traders

The broker currently has the largest market share in these countries:

Popularity among traders

FBS is one of the Top 100 forex and CFD brokers globally.

What is FBS known for in the trading industry?

The broker is renowned for providing accessible and comprehensive trading services, catering to both novice and experienced traders.

How does FBS stand out among trading platforms?

The broker stands out for its commitment to innovation, offering a wide range of trading instruments, low spreads, and various promotions.

At a Glance

| 🏛️ Headquartered | Belize |

| 🏛️ Local office in Yaoundé? | No |

| 👍 Accepts Cameroonian Traders? | Yes |

| 📅 Year Founded | 2009 |

| 📱 Cameroonian Office Contact Number | None |

| ⚖️ Regulation | IFSC, CySEC, ASIC |

| 🔎License Number | Belize – 000102/198 Cyprus (Tradestone) – 331/17 Australia (IFM) – 426359 |

| ⚖️ BEAC Regulation | None |

| ✴️ Regional Restrictions | Japan, United States, Canada, United Kingdom, Myanmar, Brazil, Malaysia, Israel, the Islamic Republic of Iran |

| ☪️ Islamic Account | Yes |

| 📈 Demo Account | Yes |

| 📈 Retail Investor Accounts | 7 |

| 🚀 Offers a XAF Account? | No |

| 💻 Dedicated Cameroonian Account Manager? | No |

| 📈 Maximum Leverage | 1:3000 |

| 📈 Leverage Restrictions for Cameroon? | No |

| 💳 Minimum Deposit | 1 USD / 603 XAF |

| 💳 XAF Deposits Allowed? | Yes |

| 💰 Active Cameroonian Trader Stats | Unknown |

| 👥 Active FBS customers | 23 million+ |

| 💰 Cameroon Daily Forex Turnover | $5 trillion+ (Overall Forex Globally) |

| 💳 Deposit and Withdrawal Options | MTN Mobile Money Orange Mobile Money USDT TRC20 Bitcoin Skrill Credit/Debit Cards Ethereum Perfect Money Litecoin Bitcoin Cash Neteller Sticpay USDT ERC20 |

| 💰 Segregated Accounts in Cameroon | No |

| 💻 Trading Platforms | FBS Trader MetaTrader 4 MetaTrader 5 CopyTrade Platform |

| 💰 Tradable Assets | Forex Precious Metals Indices Energies Stocks Exotic Forex Cryptocurrencies |

| 🌐 FBS USD/XAF Forex Pair? | No |

| 📈 Offers Cameroonian Stocks and CFDs | No |

| 👨💼 Languages supported on Website | English, German, Spanish, French, Italian, Portuguese, Indonesian, Malay, Vietnamese, Turkish, Korean, and others |

| 👥 Customer Support Languages | Multilingual |

| 👥 Customer Service Hours | 24/7 |

| 👥 Cameroon-based customer support? | No |

| 💰 Bonuses and Promotions for Cameroonians | Yes |

| ✴️ Education for Cameroonian beginners | Yes |

| 📊 Proprietary trading software | Yes |

| 💰 Most Successful Cameroonian Trader | Unknown |

| ✔️ Is FBS a safe broker for Cameroonian? | Yes |

| ✔️ Rating for FBS in Cameroon | 9/10 |

| ✔️ Trust score for FBS in Cameroon | 75% |

| 🎉 Open an account | Open Account |

Regulation and Safety of Funds

The broker is not currently regulated by the Bank of Central African States (BEAC). However, they are well-regulated by several reputable market regulators in other countries.

Security while Trading

Is FBS a regulated broker?

Yes, they are a regulated broker. They operate under the IFSC of Belize, ensuring compliance with regulatory standards and providing a secure trading environment.

How does FBS ensure the safety of funds?

The broker prioritizes the safety of client funds by employing advanced security measures, including encryption protocols.

Awards and Recognition

The broker has won more than 70 industry awards over the years that it has been providing trading solutions worldwide, including some of the following most recent awards:

Has FBS received any industry awards?

Yes, the broker has received multiple industry awards, recognizing its excellence in online trading.

What awards has FBS won recently?

They have been recognized with awards for their outstanding services, including accolades for being the “Best Forex Broker in Asia” and other categories.

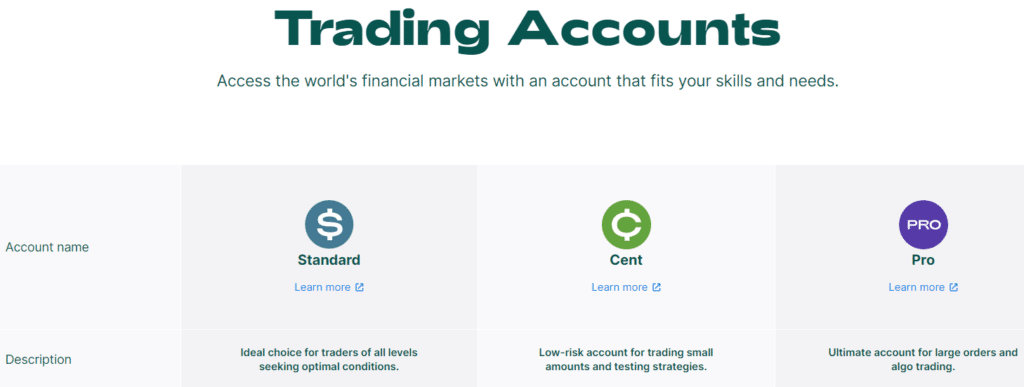

FBS Account Types and Features

Cent Account

The Cent account is tailored for novice traders, offering the opportunity to start with small investments and trade in micro-lots. It provides a low-risk environment for learning and practising trading strategies.

| 💰 Minimum Deposit Requirement | 1 USD / 603 XAF |

| 📊 Spreads | Floating, from 1 pip |

| 💳 Commissions on trades | None |

| 📈 Maximum Leverage | Up to 1:1000 |

| 💵 Maximum opening positions | 200 |

| ✴️ Order volume | Between 0.01 to 1,000 cent lots |

| 💸 Market Execution | From 0.3 seconds, STP |

| 📱 Trading Platform | MetaTrader 4 MetaTrader 5 FBS Trader |

| 🌐 Tradable Instruments | Forex Precious Metals Indices Energies Forex Exotic Pairs Stocks |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Micro Account

The Micro account suits traders who want to trade with smaller volumes. It offers flexible lot sizes, allowing for precise position sizing. This account type is ideal for those wanting to increase their trading volumes gradually.

| 💰 Minimum Deposit Requirement | 1 USD / 603 XAF |

| 📊 Spreads | Fixed, from 3 pips |

| 💳 Commissions on trades | None |

| 📈 Maximum Leverage | Up to 1:3000 |

| 💵 Maximum opening positions | 200 |

| ✴️ Order volume | Between 0.01 to 500 lots |

| 💸 Market Execution | From 0.3 seconds, STP |

| 📱 Trading Platform | MetaTrader 4 FBS Trader |

| 🌐 Tradable Instruments | Forex Precious Metals |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Standard Account

The Standard account is versatile, providing access to a wide range of trading instruments and features. It offers competitive spreads, flexible lot sizes, and various trading strategies. This account type is suitable for both beginner and experienced traders.

| 💰 Minimum Deposit Requirement | 1 USD / 603 XAF |

| 📊 Spreads | Floating from 0.5 pip |

| 💳 Commissions on trades | None |

| 📈 Maximum Leverage | Up to 1:3000 |

| 💵 Maximum opening positions | 200 |

| ✴️ Order volume | Between 0.01 to 500 lots |

| 💸 Market Execution | From 0.3 seconds, STP |

| 📱 Trading Platform | MetaTrader 4 MetaTrader 5 FBS Trader |

| 🌐 Tradable Instruments | Forex Precious Metals Indices Energies Forex Exotic Pairs Stocks |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

Zero Account

The Zero account is designed for traders who seek tighter spreads and faster execution. It operates with market execution and has no requotes. It is ideal for traders who value precision and want to minimise trading costs.

| 💰 Minimum Deposit Requirement | 1 USD / 603 XAF |

| 📊 Spreads | Fixed, 0 pips |

| 💳 Commissions on trades | From $20 per lot |

| 📈 Maximum Leverage | Up to 1:3000 |

| 💵 Maximum opening positions | 200 |

| ✴️ Order volume | Between 0.01 to 500 lots |

| 💸 Market Execution | From 0.3 seconds, STP |

| 📱 Trading Platform | MetaTrader 4 FBS Trader |

| 🌐 Tradable Instruments | Forex Precious Metals Forex Exotics |

| ✔️ Islamic Account | Yes |

| 🎉 Open An Account | Open Account |

ECN Account

The ECN account offers direct market access, allowing traders to interact with liquidity providers. It provides transparent pricing, deeper liquidity, and fast execution. This account type is suitable for advanced traders who require enhanced order execution and access to interbank markets.

| 💰 Minimum Deposit Requirement | 1 USD / 603 XAF |

| 📊 Spreads | Floating from -1 pip |

| 💳 Commissions on trades | $6 |

| 📈 Maximum Leverage | Up to 1:500 |

| 💵 Maximum opening positions | None |

| ✴️ Order volume | Between 0.01 to 500 lots |

| 💸 Market Execution | ECN |

| 📱 Trading Platform | MetaTrader 4 FBS Trader |

| 🌐 Tradable Instruments | 25 forex currency pairs |

| ✔️ Islamic Account | No |

| 🎉 Open An Account | Open Account |

Pro Account

The Pro account is tailored for experienced traders, offering advanced trading conditions and features. It provides tight spreads, deep liquidity, and fast execution speed.

Traders can utilise expert advisors and advanced trading strategies. This account type is suitable for professionals seeking optimal trading conditions.

| 💰 Minimum Deposit Requirement | 200 USD / 120,677 XAF |

| 📊 Spreads | Floating from 0.5 pips |

| 💳 Commissions on trades | $0 |

| 📈 Maximum Leverage | Up to 1:2000 |

| 💵 Maximum opening positions | None |

| ✴️ Order volume | Between 0.01 to 500 lots |

| 💸 Market Execution | STP, from 0.1 seconds |

| 📱 Trading Platform | MetaTrader 4 MetaTrader 5 |

| 🌐 Tradable Instruments | 36 Forex pairs, 8 metals, 3 energies, 11 indices, 127 stocks, and 5 cryptocurrency pairs |

| ✔️ Islamic Account | No |

| 🎉 Open An Account | Open Account |

Crypto Account

The Crypto account allows traders to trade popular cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin. It offers competitive spreads, flexible leverage, and a secure trading environment.

This account type is ideal for diversifying their trading portfolio by incorporating cryptocurrencies.

| 💰 Minimum Deposit Requirement | 1 USD / 603 XAF |

| 📊 Spreads | Floating from 1 pip |

| 💳 Commissions on trades | 0.05% for opening and 0.05% for closing positions |

| 📈 Maximum Leverage | 1:5 |

| 💵 Maximum opening positions | 200 |

| ✴️ Order volume | Between 0.01 to 500 lots |

| 💸 Market Execution | From 0.3 seconds, STP |

| 📱 Trading Platform | MetaTrader 5 |

| 🌐 Tradable Instruments | Cryptocurrencies |

| ✔️ Islamic Account | No |

| 🎉 Open An Account | Open Account |

Demo Account

For Cameroon traders, a Forex demo account is a valuable tool most brokers offer, including FBS. It allows traders to practice trading with virtual funds while receiving real-time market data on the MT4 or MT5 trading platform.

By choosing the same amount of money as their future real account, traders can simulate real trading conditions, treating profits and losses seriously.

Additionally, the broker offers the opportunity to participate in the League contest, where traders can compete and potentially earn up to $900 in one tour, adding an exciting element to demo trading.

Islamic Account

The broker offers Islamic accounts specifically designed to meet the needs of Muslim traders adhering to Shariah principles. These accounts ensure compliance with Islamic finance principles and suit traders seeking Halal trading conditions. The key features of Islamic Accounts are as follows:

What’s the primary difference between the Cent and Standard accounts?

The Cent account is intended for low-risk trading and testing, whereas the Standard account provides optimal conditions for traders of all skill levels.

Are swap-free accounts available?

Yes, the broker provides an Islamic account that is swap-free and Sharia-compliant.

Min Deposit

1 USD / 603 XAF

Regulators

IFSC, CySEC, ASIC

Trading Desk

MT4, MT5, FBS Trader, CopyTrade Platform

Crypto

Yes

Total Pairs

36

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

How to open an Account

To register an account, Cameroonian traders can follow these easy steps:

Step 1 – Click on the “Open an account” button.

Visit the FBS website and click the “Open an account” button in the top right corner.

Step 2 – Complete the form.

Enter your valid email and full name. Ensure the data is correct, as it will be needed for verification and a smooth withdrawal process. Then click on the “Register as Trader” button.

Step 3 – Confirmation link.

An email confirmation link will be sent to your email address. Be sure to open the link in the same browser your open Personal Area is in. Once your email address is confirmed, you can open your first trading account. You can open a Real account or a Demo one.

FBS Vs FXPesa Vs HFM – Broker Comparison

| FBS | FXPesa | HFM | |

| ⚖️ Regulation | IFSC, CySEC, ASIC, FSCA | FCA, CMA | FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions |

| 📱 Trading Platform | MetaTrader 4 MetaTrader 5 FBS Trader CopyTrade | MetaTrader 4 MetaTrader 5 Equiti Trader App | MetaTrader 4 MetaTrader 5 HFM App |

| 💰 Withdrawal Fee | Yes | Yes | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 1 USD / 603 XAF | 5 USD / 3,016 XAF | 0 USD / 0 XAF |

| 📈 Leverage | Up to 1:3000 | 1:400 | 1:2000 |

| 📊 Spread | From 0.0 pips | 0.0 pips | 0.0 pips |

| 💰 Commissions | From $6 | $7 | $6 per round turn |

| ✴️ Margin Call/Stop-Out | 40%/ 20% | 100%/30% | 50%/20% |

| ✴️ Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | Yes | No | No |

| 📊 Cent Accounts | Yes | No | No |

| 📈 Account Types | FBS Cent Account FBS Micro Account FBS Standard Account FBS Zero Account FBS ECN Account FBS Crypto Account | Executive Account Premiere Account | Cent Account Premium Account Zero Account Pro Account |

| ⚖️ BEAC Regulation | No | No | No |

| 💳 XAF Deposits | Yes | No | Yes |

| 📊 XAF Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/6 | 24/5 |

| 📊 Retail Investor Accounts | 6 | 2 | 4 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 👉 Open an account | Open Account | Open Account | Open Account |

Trading Platforms

FBS Trader App

The FBS Trader app provides a user-friendly and intuitive trading experience. Upon registration, the app offers a comprehensive tutorial to guide users through its functionalities and navigation.

The home screen and dashboard present an intuitive layout, allowing for seamless switching between real and demo accounts.

The app incorporates valuable features such as educational videos to enhance traders’ knowledge, an integrated economic calendar to stay updated on market events, and easy access to customer support for prompt assistance.

Traders can monitor real-time statistics, conveniently open, close, and edit positions, and apply stops to open positions. Additionally, working orders can be easily managed with the ability to delete them when necessary.

MetaTrader 4

The broker provides traders with the powerful MetaTrader 4 (MT4) platform, available for Windows, Mac, Android, and iOS devices. With MT4, traders can experience a comprehensive trading environment and enhance their skills anytime, anywhere.

The platform offers a wide range of features tailored to meet the needs of traders:

MetaTrader 5

The broker presents traders with the advanced MetaTrader 5 (MT5) platform, a powerful successor that amplifies the strengths of its predecessor while introducing enhanced versatility. MT5 encompasses an array of expanded features, including a wider selection of analytical tools, the ability to trade stocks and commodities alongside currencies, and an increased variety of timeframes.

Some features include the following:

Is there a mobile trading option available?

Yes, FBS Trader is a mobile trading app allowing online trading. Furthermore, Indonesians can also use MT4 and 5 on iOS and Android devices.

Can I use algorithmic trading on the platforms?

Yes, MT4 and MT5 support algorithmic trading, which includes trading robots and Expert Advisors.

Range of Markets

Cameroonian traders can expect the following range of markets:

Does the broker offer cryptocurrency trading?

Yes, they offer 5 cryptocurrency pairs that can be traded as CFDs.

Does the broker offer options and futures trading?

No, they do not currently offer futures or options.

Broker Comparison for Range of Markets

| FBS | FXPesa | HFM | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | No | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | Yes |

Min Deposit

1 USD / 603 XAF

Regulators

IFSC, CySEC, ASIC

Trading Desk

MT4, MT5, FBS Trader, CopyTrade Platform

Crypto

Yes

Total Pairs

36

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

FBS Trading and Non-Trading Fees

Spreads

The broker charges fixed and floating spreads on account types as follows:

Commissions

Commissions are charged on the following retail investor accounts:

Overnight Fees, Rollovers, or Swaps

Cameroonian traders who hold positions for longer than 24 hours may incur charges or interest, known as overnight fees. These fees can be either credited or debited depending on the specific position of the trader.

Deposit and Withdrawal Fees

The broker does not charge Cameroonian traders any deposit fees. However, the following withdrawal fees apply:

Inactivity Fees

Dormant accounts inactive for 180 consecutive days are subject to a $5 monthly fee.

Currency Conversion Fees

Currency conversion fees are charged on XAF deposits and withdrawals.

Are there hidden fees when trading with FBS?

No, the broker takes pride in its transparency, ensuring no hidden fees.

How are overnight or swap fees calculated on FBS?

The broker calculates swap fees based on the difference in interest rates between the two traded currencies, which can be found on their platform.

FBS Deposits and Withdrawals

The broker offers Cameroonian traders the following deposit and withdrawal methods:

Are there any fees associated with withdrawals?

Yes, although the broker strives to provide fee-free withdrawals, specific methods may incur fees.

Is there a minimum withdrawal amount set?

Yes, depending on the method used, the broker may have a minimum withdrawal threshold; traders should review their withdrawal policies.

How to Deposit Funds

To deposit funds to an account, Cameroonian traders can follow these steps:

Step 1 – Log into your account.

Log in to your FBS account. If you don’t have an account, you must create one on the FBS website.

Step 2 – Go to the deposit section.

Once logged in, locate the “Deposit” or “Add Funds” option. This is usually found in the account dashboard or navigation menu.

Step 3 – Choose a deposit method.

Select your preferred payment method. FBS offers deposit options, including bank transfers, credit/debit cards, electronic payment systems (such as Neteller, Skrill, and Perfect Money), and local exchangers.

Fund Withdrawal Process

To withdraw funds from an account, Cameroonian traders can follow these steps:

Step 1 – Log into your account.

Use your credentials to access your FBS account.

Step 2 – Go to the withdrawal section.

Locate the “Withdrawal” or “Withdraw Funds” option on the account dashboard or menu.

Step 3 – Choose a withdrawal method.

Choose your desired mode of withdrawal. FBS provides a variety of withdrawal methods, including bank transfers, credit/debit cards, and electronic payment systems.

Education and Research

The broker offers the following Educational Materials to Cameroonian traders:

They also offer Cameroonian traders the following additional Research and Trading Tools:

Are the broker’s research tools updated regularly?

Yes, they ensure that its research tools, such as market analysis and news, are frequently updated to reflect current market conditions.

Are the educational resources free of charge?

Yes, most of the broker’s educational materials and resources are free.

Bonuses and Promotions

The broker offers Cameroonian traders the following bonuses and promotions:

What types of bonuses does the broker offer to its traders?

The broker currently offers a 100% deposit bonus and cashback rebate program.

How frequently does the broker introduce new promotions?

The broker updates its promotions regularly, providing seasonal and special event bonuses to its traders.

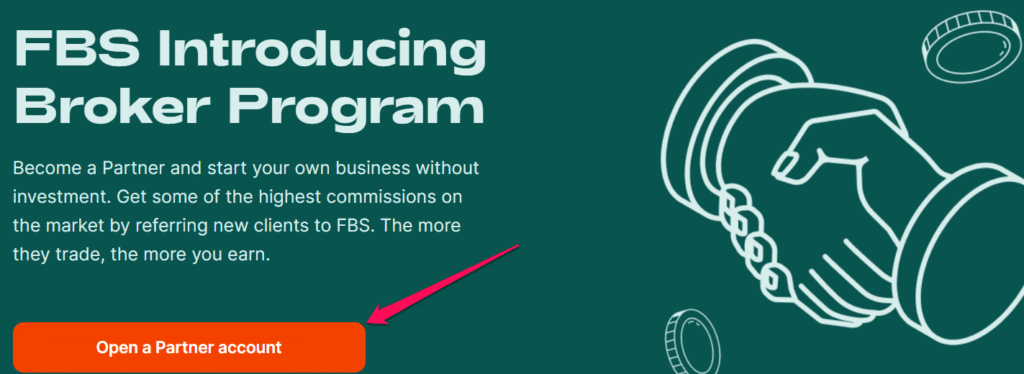

Affiliate Program Features

The Affiliate Program offers traders an excellent opportunity to become partners and establish their own businesses without any initial investment. Its attractive commission structure provides some of the highest commissions in the market for referring new clients to the broker.

One of the program’s standout features is the ability to earn commissions based on the trading activity of referred clients.

The more clients trade, the more the affiliate partner earns, creating a strong incentive to promote the broker’s services. Commissions can range from $10 to an impressive $80 per lot, depending on the client’s account type and the trading instruments used.

The program ensures that partners receive their commissions promptly by crediting them to their Partner accounts daily. This lets partners track their earnings and access detailed statistics through the Partner Area, facilitating transparent and efficient financial management.

Flexibility is another advantage of the Affiliate Program. Partners can withdraw their earnings whenever they desire, with no restrictions or limits on the withdrawal amounts.

Additionally, a wide range of payment methods is provided for convenient and hassle-free transactions.

For those looking to expand their earning potential, the program offers a multi-level partnership structure called “Cascades by FBS.” This allows partners to earn an additional 20% of the income generated by their referred affiliate partners, enhancing their overall profitability.

The broker provides various tools and resources to assist partners in maximising their business growth.

These include advertising materials such as website banners, social media, and offline materials, enabling partners to promote the broker services effectively. The Help Centre, articles, checklist, and YouTube videos further equip partners with valuable tips and guidance.

What percentage of commission can I expect as an affiliate?

They provide competitive commission rates reaching up to 43% of the spread; however, rates may vary depending on the affiliate’s performance.

Are there any performance bonuses for top-performing affiliates?

Yes, the broker frequently rewards top-performing affiliates with additional bonuses and incentives, but details should be found in the affiliate program terms.

How to open an Affiliate Account

To register an Affiliate Account, Cameroonians can follow these steps:

Step 1 – Go to the “IB Program” section.

Find the “IB Program” button on the FBS website.

Step 2 – Open an account.

Click the “FBS IB Program” button and “Open a Partner account.”

Step 3 – Fill out the form.

Sign up with your Google, Facebook, or email credentials to complete the registration process.

Customer Support

| ⏰ Operating Hours | 24/7 |

| 👥 Support Languages | English, Portuguese, Indonesian, Malay, Vietnamese, Arabic, Hindi, Chinese, and more |

| 💬 Live Chat | Yes |

| 💻 Email Address | Yes |

| 📱 Telephonic Support | Yes |

| ✔️ The overall quality of Admirals Support | 4/5 |

Does the broker offer customer support in multiple languages?

Yes, they serve a global clientele and offer customer service in multiple languages.

How can I escalate a concern if I’m unsatisfied with the initial response?

If dissatisfied with the initial support, you can request to speak with a supervisor or escalate your concern through the proper channels.

Corporate Social Responsibility

FBS’s commitment to corporate social responsibility is centred around ensuring that individuals who utilise their trading services experience the benefits of financial freedom. Furthermore, the broker actively collaborates with charitable organisations on a global scale to assist those in need.

To engage traders meaningfully, the broker conducts a monthly social media campaign called “Desires Come True.” This campaign enables traders to share their most cherished wishes with the broker, who then strives to fulfil them.

Witnessing the transformative impact of these acts of kindness through the contest, the team consistently witnesses how lives are positively changed.

In line with their dedication to social responsibility, they also organise an annual charity trade promotion in collaboration with local and international organisations. During this promotion, the broker doubles a trader’s deposit, and any commissions earned are directed towards supporting charitable causes.

This collective effort demonstrates FBS’s commitment to making a positive difference and contributing to the planet’s betterment.

What is FBS’ approach to corporate social responsibility?

They are committed to CSR and actively engage in various initiatives aimed at giving back to the community and promoting social well-being.

How can I learn more about their corporate social responsibility efforts?

To learn more about their corporate social responsibility initiatives and the specific projects they are involved in, you can visit their official website or contact their customer support.

Verdict

Overall as a trading platform, FBS has several strengths that make it a viable choice for both beginners and experienced traders.

The platform offers comprehensive educational materials, including webinars, seminars, a detailed glossary, and a helpful FAQ section. This makes it a great starting point for beginners new to trading.

10 Best Forex Brokers in Cameroon

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker is regulated in a few regions by well-known entities. | The broker offers a limited number of assets, less than 300, which may not meet the needs of traders looking for a wider variety. |

| There are seven retail accounts offered. | There are limitations to the services available for EU traders, with not all account types supported and fewer assets to trade. |

| Traders could expect spreads from -1 pips in ideal market conditions on the ECN Account. | Certain features, like a demo account, are available for 90 days. |

| The Cent account is ideal for beginners who need a steady introduction to trading. | Some account types, like the Pro account, require a higher minimum deposit. |

| There is a demo account available. | |

| They have a range of trading tools and educational materials. |

you might also like: FXPesa Review

you might also like: Exness Review

you might also like: easyMarkets Review

you might also like: Admirals Review

you might also like: AvaTrade Review

Frequently Asked Questions

What are the strengths of FBS?

FBS’s strengths include various account types, a range of markets, high leverage, and comprehensive educational resources.

How can I deposit funds into my FBS account?

The broker offers deposit options, including bank transfers, credit/debit cards, electronic payment systems, and local exchangers.

Does FBS have Nasdaq 100?

Yes, they offer Nasdaq 100 under NAS100, with spreads from 2 pips.

Does FBS offer educational resources?

Yes, the broker provides comprehensive educational materials, including webinars, seminars, a detailed glossary, and a helpful FAQ section.

What types of accounts does FBS offer?

They offer a variety of account types, including Cent, Micro, Standard, ECN, Crypto, Zero Spread, and Pro accounts.

Is FBS Safe or a Scam?

They are a safe broker that is well-regulated. Furthermore, FBS keeps all client funds in segregated accounts and provides several security features.

Does FBS offer a demo account?

Yes, the broker offers a demo account, but its availability is limited to 90 days.

Is FBS regulated?

Yes, they are well-regulated by the IFSC, CySEC, and ASIC.

What markets can I trade with FBS?

The broker offers trading in Forex, precious metals, indices, energies, stocks, exotic Forex, and cryptocurrencies.

How long does it take to withdraw from FBS?

Withdrawals are processed quickly by the broker once the request is received. It could take a few minutes or up to 7 days for funds to reflect in your bank account.

CFA Franc Forex Trading Accounts

CFA Franc Forex Trading Accounts

Scam Forex Brokers in Cameroon

Scam Forex Brokers in Cameroon